Combination Life and Long Term Care Insurance Shared Care – Long Term Care University – 09/15/13

Long Term Care University – Question of the Month – 09/15/13

Research

By Aaron Skloff, AIF, CFA, MBA

Q: We read the 1st, 2nd, 3rd, 4th , 5th and 6th Long Term Care University articles on Combination Life and Long Term Care insurance policies and decided to purchase a Combination policy. Like a Shared Care Traditional Long Term Care Insurance, can we purchase a Shared Care Combination (Hybrid or Linked Benefits or Asset Based) Life and Long Term Care (LTC) insurance policy?

The Problem – You or Your Spouse Need More Care than Your Individual Policy Covers

Most Traditional and Combination Long Term Care insurance policies are designed as individual policies that insure one person. In the event you may need more care than your individual policy covers your spouse cannot give or share their benefits with you.

For example, you and your spouse each have a long term care (LTC) insurance policy with a $150 daily benefit and a 33 month benefit period, obligating the insurance company to pay $150 per day for 33 months for a total of approximately $150,000 per person. Unfortunately, you may need more than 33 months of care. If you need an additional 33 months of care at $150 per day, it will cost you $150,000 out of pocket. This example ignores the income taxes and early withdrawal penalties associated with the withdrawal of many retirement assets. It also ignores the devastating effects of inflation, which can wreak havoc on a lifetime of savings if your LTC insurance policy does not have inflation protection.

The Solution – Combination Life and Long Term Care Insurance with Shared Care Option

A Shared Care policy provides you the ability to share your benefits with your spouse. In the example above, you can use the shared pool of LTC benefits and avoid $150,000 in long term care expenditures. The mere avoidance of this expenditure can mean the difference between a secure and an insecure retirement. All those assumptions are based on current dollars. If this example was 25 years in the future and the cost of care (along with your policy’s benefits) rose at 5% per year, the Shared Care policy would save you over $500,000 in expenditures. With a Shared Care policy the initial set of benefits that you and/or your spouse consume at the same time are the base and a subsequent set of benefits that you and/or your spouse consume at the same time are the continuation.

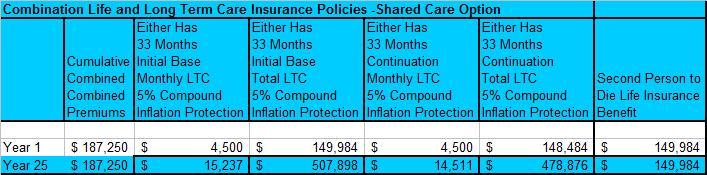

Numbers Speak Louder than Words. Let’s look at a husband and wife that are each 55 years of age. If they make a combined one-time premium payment of $187,250 they each immediately gain a tax free base of $4,500 monthly LTC benefit or $149,984 available over 33 months that one or both can consume. They also immediately gain a second person to die tax free $149,984 death benefit. Each $1 of LTC paid by the policy depletes the death benefit by $1. Their base benefits will grow at a fixed 5% compound growth rate. In 25 years when they are likely to need LTC at the age of 80, they will have a tax free base $15,237 monthly LTC benefit or $507,898 available over 33 months that one or both can consume. After using the base benefits, they will have continuation of benefits.

With the continuation of benefits, they each immediately gain a tax free continuation of $4,500 monthly LTC benefit or $148,484 available over 33 months that one or both can consume. Their continuation benefits will grow at a fixed 5% compound growth rate. In 25 years when they are likely to need care at the age of 80, they will have a tax free continuation $14,511 monthly LTC benefit or $478,876 available over 33 months that one or both can consume. If they do not use the LTC benefits the policy will pay a tax free $149,984 death benefit.

Click to Enlarge

Action Step – Purchase a Combination Life and Long Term Care Insurance Policy with Shared Care

Since the length of care you will need is unknown, purchasing a Shared Care policy can double the benefits available for a spouse and reduce the risk of out of pocket LTC costs. You share everything else, why not share your LTC insurance benefits?

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA), is the Chief Executive Officer of Skloff Financial Group, a Registered Investment Advisory firm. The firm specializes in financial planning and investment management services for high net worth individuals and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.