Combination Life and Long Term Care Insurance Inflation Protection Options – Long Term Care University – 07/15/13

Long Term Care University – Question of the Month – 07/15/13

Research

By Aaron Skloff, AIF, CFA, MBA

Q: I am a female reader, who read the 1st, 2nd, 3rd and 4th Long Term Care University articles on Combination Life and Long Term Care insurance policies and decided to purchase a Combination policy. What inflation protection options are available on Combination (Hybrid or Linked Benefits) Life and Long Term Care (LTC) insurance policies?

The Problem – Determining Which Type and Whether or Not to Purchase Inflation Protection

Most insurance policies offer you the option to remove the inflation protection option from your policy when applying. Unfortunately, many consumers shortchange themselves when they either forgo the purchase of inflation protection or they purchase an inadequate level of inflation protection. A policy with adequate coverage today, with inadequate or no inflation protection, cannot keep pace with the 4%-5% compound price increases long term care service providers have been implementing.

The Solution – Purchasing Adequate Inflation Protection

Purchasing a LTC insurance policy with inflation protection increases the policy’s benefits each year and reduces the risk that an adequate level of coverage today will become inadequate in the future. Most insurance companies offer the option of 3% or 5% compound inflation protection of monthly and total benefits.

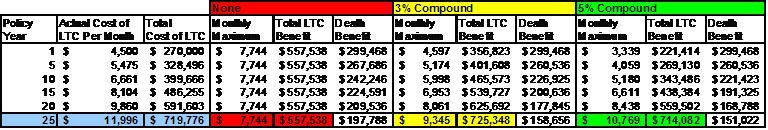

Numbers Speak Louder than Words. Let’s look at a 55 year-old female who makes a one-time $100,000 policy payment. We compare three options: 1) no inflation protection, 2) 3% compound inflation protection and 3) 5% compound inflation protection. We assume the monthly cost of long term care services are $4,500 and will grow at a 4% compound growth rate. And, we assume she will need five years of care in 25 years, when she is 80 years-old – as indicated in the blue section of the table below. Since 7 in 10 people who live to age of 65 and beyond will need long term care, we primary focus is on the long term care benefits.

No Inflation Protection. Although she starts out with the highest monthly and total benefit, she has the least monthly and total benefit at the age of 80 – as indicated in the red section of the table below.

3% Compound Inflation Protection. Although she starts out with a lower monthly and total benefit than the no inflation option, she has a higher monthly and total benefit at the age of 80 – as indicated in the yellow section of the table below.

5% Compound Inflation Protection. Although she starts out with a lower monthly and total benefit than the 3% compound inflation option, she has a 15.2% higher monthly and only 1.6% lower total benefit at the age of 80 – as indicated in the green section of the table below. The much higher monthly benefit far outweighs the slightly lower total benefit.

Click to Enlarge

Clearly, both the 3% compound and 5% compound inflation protection option provide higher monthly benefits than the no inflation protection option. The 5% compound inflation protection option provides a much higher monthly benefit than the 3% option – a very valuable benefit in the face of high monthly long term care services and the risk of care lasting less than five years.

Action Step – Always Compare Multiple Inflation Protection Options Before Purchasing a Policy

Since it is unlikely that you will need long term care in the earlier years of your policy, it critically important to understand what your monthly and total benefit will be when you are likely to need it.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA) charter holder, Master of Business Administration (MBA), is the Chief Executive Officer of Skloff Financial Group, a NJ based Registered Investment Advisory firm. The firm specializes in financial planning and investment management services for high net worth individuals and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.