Combination Life and Long Term Care Insurance Tax Benefits 2016 – Long Term Care University

Long Term Care University – Question of the Month – 05/15/16

By Aaron Skloff, AIF, CFA, MBA

Q: Can Combination and Life and Long Term Care Insurance (Combo or Hybrid) be offered as a company benefit? If so, are there any tax advantages for employers or employees? Are there tax advantages for individuals who buy a policy on their own?

The Problem – Attracting and Retaining Valuable Employees with Competitive Compensation

Offering an attractive benefits package can be a key element in attracting and retaining the highest quality employees.

Click Here for Your Long Term Care Insurance Quotes

The Solution – Offer Long Term Care Insurance as a Company Benefit to Employees

Whether the business is a sole proprietor or multi-national corporation, long term care insurance can be offered as a company benefit. Unlike most company benefits, which prohibit the employer from discriminating, long term care insurance can be offered on a limited basis to certain classes of employees or on an unlimited basis at the company’s discretion.

Tax Advantages for Businesses and Employees

C corporations can deduct the full amount of Combination base and continuation premiums paid for owners and employees, their spouses and dependents as a business expense. The base premium is reported as compensation to the owners and employee.

Sole proprietors cannot deduct the owner’s base premium, but can deduct the owner’s continuation premium subject to age limits.

Sole proprietors can deduct employees’ base and continuation premiums. The base is reported as compensation to the employee.

Partnerships, LLCs and S Corps can deduct the owners’ base and continuation premiums. The base and continuation premiums are reported as compensation to the owners. The continuation premium is subject to age limits.

Partnerships, LLCs and S Corps can deduct the employees’ base and continuation premiums. The base premium is reported as compensation to the employees.

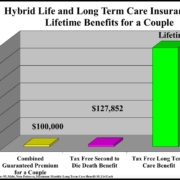

Click to Enlarge

Tax Advantages for Individuals Purchasing Their Own Policy

Individuals and employees may be able to deduct all or a portion of the continuation premium. They can add the continuation premium to other medical expenses, including health insurance premiums. Amounts in excess of 10% (7.5% if 65 years old or over) of adjusted gross income (AGI) can be itemized as a medical expense deduction on Schedule A of Form 1040 of federal income tax return, limited to the age based limits chart below. Premiums paid from an HSA are not subject to AGI rules, but subject to the age based limits chart below.

Click to Enlarge

Action Step – Offer Long Term Care Insurance as a Company Benefit to Employees and Take Advantage of Tax Benefits

Whether you are a sole proprietor, the benefits director of a mid sized LLC or the CEO of a multi-national corporation, implementing long term care insurance as an employee benefit can have tremendous qualitative and quantitative benefits. Request your insurance consultant provide you quotations from multiple vendors before choosing a plan.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA) charter holder, Master of Business Administration (MBA), is the Chief Executive Officer of Skloff Financial Group, a Registered Investment Advisory firm. The firm specializes in financial planning and investment management services for high net worth individuals and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.