Community Living Assistance Services and Support (CLASS) Act Cancelled – Long Term Care University – 10/15/11

Long Term Care University – Question of the Month – 10/15/11

Research

By Aaron Skloff, AIF, CFA, MBA

Q: Has the Community Living Assistance Services and Support (CLASS) Act you published about on July 15, 2011 been canceled?

The Problem – The Holy Grail with Lots of Holes

The Community Living Assistance Services and Support (CLASS) Act was designed by the late Senator Edward Kennedy as a voluntary insurance program to help adults age 18 and over with disabilities pay for long term services and supports. In March 2010, President Barack Obama signed into law the Patient Protection and Affordable Care Act, establishing the CLASS program. According to a report by the U.S. Department of Health and Human Services, entitled “A Report on the Actuarial, Marketing, and Legal Analyses of the CLASS Program”:

“Almost seven out of ten people turning age 65 today will experience, at some point in their lives, functional disability and will need some paid or unpaid help with basic daily living activities. While most people who need long-term care are in their 70s and 80s, young people also can require care, with 40 percent of long-term care users today between the ages of 18 and 64.”

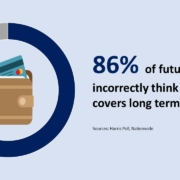

“Medicare does not cover long-term care services.”

Like many group long term care insurance policies offered through businesses and the Federal Long Term Care Insurance Program, the CLASS Act would allow for participation without full underwriting (the process of reviewing medical and health related information to determine if an applicant presents an acceptable level of risk). According to my July 15, 2011 article:

“The CLASS program will be available on a guaranteed-issue basis to all actively working individuals who are at least 18 years old and not already receiving care in a facility. Since there are no underwriting requirements there be will be a significant number of high risk and/or disabled enrollees. This presents a good opportunity for enrollees with poor health and a tremendous liability for enrollees with average or good health. Healthy enrollees will likely need to subsidize enrollees with poor health, as premiums are likely to rise when those with poor health require long term care.”

The lack of full underwriting would have been a disaster to the CLASS Act. Without full underwriting the groups of people being insured are like a ticking time bomb. Sooner or later, the lack of underwriting will rear its ugly head in the form of higher than expected claims and blow up like a time bomb.

On October 14, 2011, Kathleen G. Sebelius, Secretary of the U.S. Department of Health and Human Services, said: “But despite our best analytical efforts, I do not see a viable path forward for CLASS implementation at this time.” Kathy J. Greenlee, Assistant Secretary for Aging at the U.S. Department of Health and Human Services and the Administrator of the CLASS Act, said: “We do not have a viable path forward. We will not be working further to implement the CLASS Act.” Maybe Ms. Sebelius and Ms. Greenlee read my article?

The Solution – Finding a Viable Alternative to the Canceled CLASS Act

As evidenced above, there are no free lunches when it comes to long term care insurance. Unlike many group long term care insurance policies, individual polices require an application and full underwriting by the insurance company. Although full underwriting may require the completion of a health release form or interview, it is a sound way of eliminating high risk policyholders. Those issued a policy by the insurance company know they are joining a pool of generally healthy people. A healthy group of people will likely have reasonable claims when they need long term care in the future, assuring the viability of the insurance.

Many individual long term care insurance policies are certified under Long Term Care Insurance Partnership Programs. Most states’ Long Term Care Partnership Programs allow long term care insurance policyholders to protect their assets from Medicaid on a Dollar for Dollar basis – for every dollar your policy pays in benefits, a dollar of assets is ignored by Medicaid. Some states, including New York, offer 100% Medicaid asset protection through Total Asset Protection – an unlimited amount of assets are ignored by Medicaid.

Action Step – Purchase Long Term Care Insurance from a Viable Source

You will probably pass out from a lack of oxygen if you wait for the U.S. government to introduce a viable long term care insurance program. Avoid the risks associated with group polices and their lax underwriting requirements. Instead, purchase an individual long term care insurance policy with full underwriting. You will pay full price for your lunch, but at least it will be there at lunchtime.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA) charter holder, Master of Business Administration (MBA), is the Chief Executive Officer of Skloff Financial Group, a NJ based Registered Investment Advisory firm. The firm specializes in financial planning and investment management services for high net worth individuals and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.