Genworth Life Privileged Choice Flex 3 Long Term Care Insurance Review – Long Term Care University – 08/15/18

Long Term Care University – Question of the Month – 08/15/18

Research

By Aaron Skloff, AIF, CFA, MBA

Q: We read the Long Term Care University article that compares Traditional to Combination Life and Long Term Care (LTC) Insurance and prefer the Traditional LTC policy. Can you please review the Genworth Life Privileged Choice Flex 3 Traditional LTC policy?

Overview. Genworth Life is an A.M. Best B- rated, 147-year-old company. The Genworth Life Privileged Choice Flex 3 policy is s a Traditional Long Term Care Insurance policy. Traditional Long Term Care Insurance policies provide the highest level of LTC benefits for the lowest premiums and can be designed to meet Long Term Care Partnership Program requirements to protect your assets away from Medicaid.

Click Here for Your Long Term Care Insurance Quotes

Genworth Life Privileged Choice Flex 3 is Unique Because It Provides an Optional Informal Care Rider. Most LTC insurance policies prohibit informal care. With the Genworth Life Privileged Choice Flex 3 informal care rider, the policy will cover informal care expenses up to 50% of your selected daily or monthly home and community care maximum benefit.

Informal Care Rider Example. If you have a $3,300 monthly benefit, the 50% informal care rider benefit would be $1,650. If a home health care agency charges $22 per hour, $1,650 would cover 60 hours of care – about 3.75 hours a day, 5 days a week. If an informal care provider (immediate family members like spouses, partners and children are excluded) charges $10 per hour, $1,650 would provide 165 hours of care – about 8.25 hours a day, 5 days a week. The same $1,650 provides more than twice as many hours per day.

Genworth Life Privileged Choice Flex 3 is Unique Because It Offers an Optional Shared Care with Guaranteed Minimum Additional Benefits and a Joint Waiver of Premium Rider. Most LTC insurance policies are individual policies that insure one person. Unfortunately, you may need more care than your policy covers. Your spouse would not be able to give you any of their benefits. Shared care policies provide extra protection if you need more care. Most shared care policies allow spouses to use each other’s benefits and if one spouse dies, their unused coverage will transfer to the survivor’s policy. But, this could leave one spouse with insufficient benefits when they need care.

Genworth Life Privileged Choice Flex 3’s shared care rider has a 50% guaranteed minimum additional benefit. For example, if a couple each purchased a $110 daily benefit with five years of care, they would each have $200,750 in benefits or $401,500 in total benefits, in year 1. If one spouse used all their benefits, the other spouse would still a benefit equal to 50% of their original benefit, or $100,375. Their total benefits including the guaranteed minimum additional benefits would be $501,875, in year 1. Thus, offering 25% more benefits. Lastly, the shared care feature has a joint waiver of premium. So, if either if either spouse needs care both spouses’ premiums are waived.

Mutual of Omaha MutualCare Secure Solution Options. The policy options include: Daily or monthly benefits; Inflation protection of none, 2%-5% compound; Elimination period of 30 – 365 days; Reimbursement based benefit payment method; Shared care with guaranteed minimum and joint waiver of premium; Informal Care; Waiver of elimination period for home health care.

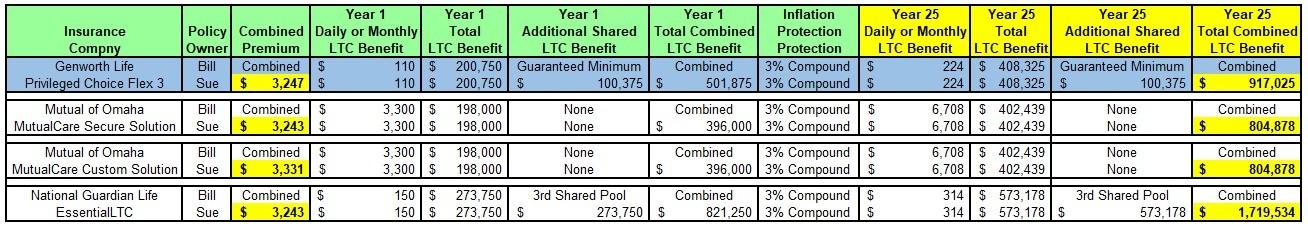

How Genworth Life Privileged Choice Flex 3 Compares with Other Traditional LTC Policies. Let’s look at a husband and wife, Bill and Sue, who are each 55 years old, reside in New Jersey and expect to need LTC in 25 years at the age of 80. They are comparing Traditional policies with a combined annual premium of approximately $3,200 with 3% compound inflation protection included in the premium, 90 day elimination, 5 years of care each, shared care and prefer monthly and cash benefits (highlighted in blue in the chart below).

Genworth Life Privileged Choice Flex 3 Outperforms Competitors with a Guaranteed Minimum Additional Benefit. Bill and Sue will each will have $224 daily and $917,025 total combined LTC benefits. Genworth Life Privileged Choice Flex 3 is a strong alternative due to its guaranteed minimum additional shared LTC benefit. Mutual of Omaha MutualCare Secure Solution and Mutual of Omaha MutualCare Custom Solution are notable for its monthly benefit and partial cash benefit payment method. National Guardian Life EssentialLTC is a strong alternative due to its shared care with an additional third shared pool of benefits and lifetime benefits options.

Click to Enlarge

Action Steps and Conclusions. Compare each company’s total combined LTC benefits. Genworth Life Privileged Choice Flex 3 has options for informal care and a unique with shared care with guaranteed minimum additional benefits and a joint waiver of premium rider. Since premiums vary greatly based on age, health and marital status, request individualized quotes.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA) charter holder, Master of Business Administration (MBA), is the Chief Executive Officer of Skloff Financial Group, a Registered Investment Advisory firm. The firm specializes in financial planning and investment management services for high net worth individuals and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.

Click Here for Your Long Term Care Insurance Quotes

National Guardian Life Insurance Company is not affiliated with the Guardian Life Insurance Company of America, a.k.a The Guardian or Guardian Life.