Dividend Paying Stocks 1928-2010 – Independent Press

The Independent Press

Money Matters – Skloff Financial Group Question of the Month – March 7, 2012

By Aaron Skloff, AIF, CFA, MBA

Q: Do dividend paying stocks generate lower returns than non-dividend paying stocks. And if so, should they simply be a substitute for bonds?

Many investors assume companies pay dividends when the companies no longer need the cash flow: to grow their businesses, fund research and development of new products or services, or to open new manufacturing facilities. Many investors assume dividend paying stocks are a substitute for bonds.

Are You Interested in Learning More?

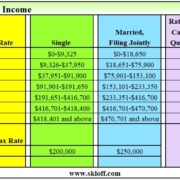

Institutional investors have known for decades that dividend paying stocks have outperformed non-dividend paying stocks and have done so with less risk. Heartland Advisors recently published a study utilizing a number of highly regarded sources. They concluded that dividend paying stocks out performed non-dividend paying stocks from 1928 to 2010. Dividing the stocks into quintiles, based on dividend yield, the study showed the fourth highest yielding quintile generated the highest returns; over 2.5% higher annualized return in comparison to the lowest yielding quintile and over 3.2% higher annualized return in comparison to non-dividend paying stocks.

Investment returns are as important as investment risk, with risk defined as standard deviation – the lower the standard deviation, the lower the risk and vice versa. Not only did the fourth highest yielding quintile generate the highest returns, but it did so with below average risk. The highest yielding quintile’s standard deviation was over 1.1% lower than lowest yielding quintile and 12.4% lower than non-dividend paying stocks.

Yield Traps. Interestingly, the highest yielding stocks were only the second best performers and had the highest risk of all five quintiles. Some of the highest yielding stocks gained their position when their stock prices dropped and their dividend remained static, hurting their overall return. An unusually high dividend yield can be a precursor to a dividend reduction or elimination. One way to evaluate the sustainability of a company’s dividend is to calculate a company’s payout ratio (dividends divided by net income). A high or rising dividend ratio can be a red flag. These yield traps can turn into disasters, as the company may reduce or eliminate its dividend.

Dividend Paying Stocks are Not a Substitute for Bonds. Bond investors have experienced an unprecedented bull market in the last 10 years. Realistic bond investors recognize, when the 10-year Treasury Bond is yielding less than 2%, the bull market is about to end. In order to replace or enhance the yields they desperately need, many bond investors have shifted some or all of their bond investments into dividend paying stocks without understanding the tradeoff they have made.

Unfortunately, a 2% dividend yield is very different than a 2% yield on a bond. While non-dividend paying stocks have exhibited higher risk than dividend paying stocks, dividend paying stocks have exhibited higher risk than bonds. Furthermore, bonds generate interest that is generally subject to income taxes. Remember: it is not what you make, but what you keep.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA) is CEO of Skloff Financial Group, a Registered Investment Advisory firm based in Berkeley Heights. He can be contacted at www.skloff.com or 908-464-3060.