How a Gift Can Be a Tax Dream or a Tax Nightmare – Part 2

Money Matters – Skloff Financial Group Question of the Month – May 1, 2024

By Aaron Skloff, AIF, CFA, MBA

Q: We read ‘How a Gift Can Be a Tax Dream or a Tax Nightmare’ Part 1. We are considering gifting assets to our children and/or our parents? What are the tax benefits and detriments of gifting?

The Problem – How a Gift Can Be a Tax Dream or a Tax Nightmare

Many people gift assets to their children and/or parents with the best intentions. Those gifts may generate tax benefits to you, your children, your parents, or all parties – a tax dream. On the other hand, those gifts may generate tax detriments to you, your children, your parents, or all parties – a tax nightmare.

The Solution – A Side-by-Side Comparison of a Tax Dream to a Tax Nightmare

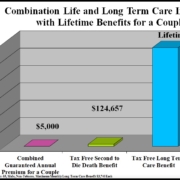

By examining a side-by-side comparison in the chart below, you can see how a gift can create a tax dream or a tax nightmare.

Are You Interested in Learning More?

Gifts That Generate Tax Detriments to Parents, Children or Both – A Tax Nightmare

To simplify the comparison, all parties are not subject to tax on a child’s investment and other unearned income (Kiddie Tax) or state taxes.

If you (“donor”) gift a $18,000 mutual fund, for which you originally paid (“cost basis”) $5,000, to one of your children and/or your parent (“donee”), neither you nor they have to pay a gift tax – a tax dream.

Gifting Mutual Fund – Donor at 20% Capital Gains Tax Rate Plus 3.8% Surtax – Donee at 0% Capital Gains Rate Plus 0% Surtax. If your child and/or parent immediately sells the $18,000 mutual fund, they may be subject to a capital gains tax on the $13,000 gain based on how long you owned the mutual fund and their income level. The capital gains tax rate is their income tax rate for short term capital gains if you owned the mutual fund for one year or less. Based on their low income, their income tax rate would be 0% – a tax dream. If it is a long term capital gain because you owned the mutual fund for more than one year, their capital gains tax rate, based on their low income, would be 0% – a tax dream. The mitigation or elimination of taxes is a form of legal tax arbitrage.

Instead, had you sold the mutual fund, and realized a short term capital gain, based on your high income, your income tax rate would be 37% – a tax nightmare. Instead, based on your high income, had you sold the mutual fund, and realized a long term capital gain, you would have be subject to a 20% capital gains tax of $2,600 ($13,000 X 20%) – a tax nightmare. In addition to the capital gains tax, based on your high income, you would have been subject to an additional 3.8% investment surtax of $494 ($13,000 X 3.8%) – a tax nightmare.

Click to Enlarge

Gifting Mutual Fund – Donor at 0% Capital Gains Tax Rate Plus 0% Surtax – Donee at 20% Capital Gains Rate Plus 3.8% Surtax. If your child and/or parent immediately sells the $18,000 mutual fund, they may be subject to a capital gains tax on the $13,000 gain based on how long you owned the mutual fund and their income level. The capital gains tax rate is their income tax rate for short term capital gains if you owned the mutual fund for one year or less. Based on their high income, their income tax rate would be 37% – a tax nightmare. Based on their high income and based on a long term capital gain, they would be subject to a 20% capital gains tax of $2,600 ($13,000 X 20%) – a tax nightmare. In addition to the capital gains tax, based on their high income, they would have been subject to an additional 3.8% investment surtax of $494 ($13,000 X 3.8%) – a tax nightmare.

Instead, had you sold the mutual fund, and realized a short term capital gain, based on your low income, your income tax rate would be 0% – a tax dream. Instead, based on your low income, had you sold the mutual fund, and realized a long term capital gain because you owned the mutual fund for over one year, your capital gains tax rate would be 0% – a tax dream.

Click to Enlarge

Action Steps

Work closely with your Registered Investment Adviser (RIA) to reduce your taxes, and grow and preserve your wealth.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA) is CEO of Skloff Financial Group, a Registered Investment Advisory firm specializing in financial planning, investment management and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.