Combination Life and Long Term Care Insurance Lifetime Payments – Long Term Care University – 10/15/13

Long Term Care University – Question of the Month – 10/15/13

Research

By Aaron Skloff, AIF, CFA, MBA

Q: We read the 1st, 2nd, 3rd, 4th , 5th and 6th and 7th Long Term Care University articles on Combination Life and Long Term Care (LTC) insurance policies and decided to purchase a Combination policy. Like a Traditional LTC Insurance with lifetime payments, can we purchase a Combination (Hybrid or Linked Benefits or Asset Based) Life and Long Term Care policy with lifetime payments?

The Problem – One-Time and Short Duration Premium Payments are Unappealing or Unfeasible

Some insurance companies require a one-time premium payment to purchase a Combination policy. Others offer payment options over short durations, such as: 3, 5, 7 or 10 years. Unfortunately, short duration premiums may be unappealing or unfeasible for some.

The Solution – Combination Life and Long Term Care Insurance with Lifetime Payments

Fortunately, some insurance companies offer lifetime payments, the same way you pay for your homeowners and automobile insurance. Unlike homeowners or automobile insurance, the lifetime payment policies provide guaranteed benefits and guaranteed premiums.

Numbers Speak Louder than Words

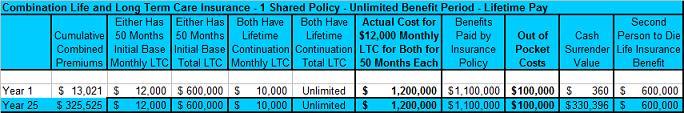

Let’s look at a husband and wife that are each 55 years of age. If they purchase one shared policy with a $13,021 annual premium they gain a tax free initial base of $12,000 monthly LTC benefit or $600,000 available over 50 months that one or both can consume. They also immediately gain a tax free continuation of $10,000 monthly LTC benefit that one or both can consume for the rest of their lives. Lastly, they immediately gain a second person to die death benefit of $600,000.

Click to Enlarge

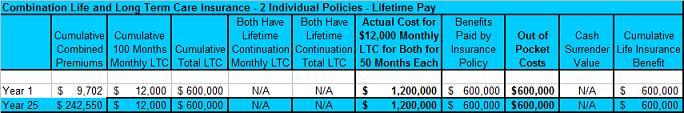

If they purchase two individual policies with a $9,702 combined annual premium they each gain a tax free $6,000 monthly LTC benefit or $300,000 ($600,000 cumulative) available over 50 months per person. They also each immediately gain a death benefit of $300,000 ($600,000 cumulative).

Click to Enlarge

Since 7 in 10 people who live to the age of 65 and beyond will need long term care, we primarily focus on the long term care benefits. We assume they both need 50 months of care in 25 years, when they are 80 years-old at a cost of $12,000 per month or a combined $1.2 million ($12,000 per month X 100 months). With the one shared policy, the insurance company pays $1.1 million ($12,000 per month X 50 months + $10,000 per month X 50 months) tax free while the couple pays $100,000 out of their own pocket. With the two individual policies, the insurance company pays a combined $600,000 ($6,000 per month X 50 months + $6,000 per month X 50 months) tax free while the couple pays $600,000 out of their own pocket.

Although the shared policy costs almost $83,000 more than the two individual policies over 25 years, it saves the couple $500,000 in out of pocket costs. Since the shared care policy provides an unlimited number of months of care, every month past the 100th saves another $10,000 in out of pocket costs. Lastly, the shared policy offers a cash surrender value (refund) if the couple ever cancels the policy.

Action Step – Purchase a Shared Combination Policy with Lifetime Payments

Purchase a shared Combination Life and Long Term Care Insurance policy and you will receive greater long term care benefits, more flexibility as to who can use the benefits and the safety net of an unlimited number of months of care.

Aaron Skloff. Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA) charter holder, Master of Business Administration (MBA), is the Chief Executive Officer of Skloff Financial Group, a NJ based Registered Investment Advisory firm. The firm specializes in financial planning and investment management services for high net worth individuals and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.