How Gifting Versus Selling Your Home Can Be a Tax Dream or a Tax Nightmare – Part 1

Money Matters – Skloff Financial Group Question of the Month – July 1, 2024

By Aaron Skloff, AIF, CFA, MBA

Q: We read ‘How a Gift Can Be a Tax Dream or a Tax Nightmare’ Part 1 and Part 2. We also read ‘How To (Legally) Avoid Taxes When Selling Your Home’ Part 1, Part 2 and Part 3. We are considering gifting our home to our child and their spouse. What are the tax benefits and detriments of gifting versus selling our home?

The Problem – How Selling Versus Gifting Your Home Can Be a Tax Dream or a Tax Nightmare

Many people gift their home to their child and spouse with the best intentions. Those gifts may generate tax benefits to those making the gifts, the children, the parents, or all parties – a tax dream. On the other hand, those gifts may generate tax detriments to those making the gifts, the children, the parents, or all parties – a tax nightmare.

The Solution – Understanding the Tax Benefits and Tax Detriments of Gifting Versus Selling Your Home

For 2024, you (“donor”) can gift up to $18,000 ($36,000 cumulatively for a couple) to as many people (“donee”) as you want without the donor or donee having to document the gift or pay taxes. These amounts are known as the “annual exclusion”. Gifts in excess of those amounts require you to file IRS Form 709 – United States Gift (and Generation-Skipping Transfer) Tax Return. For 2024, you have a cumulative lifetime gift tax and estate tax exemption of $13.61 million ($27.22 million cumulatively for a couple).

Are You Interested in Learning More?

Gifting Your Home Can Generate Tax Detriments to You, Your Child and Their Spouse or All Parties – A Tax Nightmare

If you and your spouse (donors) gift your $600,000 home (with a $100,000 costs basis) to your child and their spouse (donees), neither you nor they have to pay any taxes. Due to the annual exclusion, you and your spouse can each gift $18,000 to your child and each gift $18,000 to your child’s spouse – for a total of $72,000 ($36,000 to your child + $36,000 to your child’s spouse). When you file IRS Form 709, you can indicate your $600,000 gift, apply your $72,000 exclusion, while $528,000 ($600,000 – $72,000 exclusion) can be applied to your lifetime gift and estate tax exemption. Since neither you, your spouse, your child nor your child’s spouse pays any taxes, this appears to be a tax dream.

When it comes to estate, financial, retirement and tax planning, the devil is in the details. As examined in the articles referenced above, assets have a cost basis and may be subject to income taxes or capital gains taxes and Net Investment Income Tax (NIIT or investment surtax) upon sale. How can a tax dream become a tax nightmare?

When you gift an asset, you also gift your costs basis. Using the example above, if you and your spouse gift your $600,000 home (your primary residence), you also gift your $100,000 cost basis (Adjusted Basis). If your child and your child’s spouse sell that home (their primary residence), they may be subject to taxes, based on what price and when they sell that home – a tax nightmare.

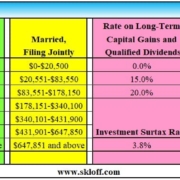

Your Child and Child’s Spouse Sell the Home Within a Year at a Gain. If your child and their spouse sell that home without making any capital improvements (such as a bathroom or kitchen renovation) for $1,100,000 in 1 year or less, based on their 35% marginal income tax bracket, they would be subject to income taxes of $350,000 ($1,100,000 selling price – $100,000 cost basis = $1,000,00 gain X 35%) plus NIIT of $38,000 ($1,000,000 gain X 3.8%). Total taxes of $388,000 would leave them with $712,000 of proceeds net of taxes – a tax nightmare.

Your Child and Child’s Spouse Sell the Home More Than 1 Year but Less Than 2 Years Later at a Gain. If your child and their spouse sell that home without making any capital improvements for $1,100,000 more than 1 year but less than 2 years later, based on their income, they would be subject to long term capital gains taxes of $200,000 ($1,100,000 selling price – $100,000 cost basis = $1,000,00 gain X 20%) plus NIIT of $38,000 ($1,000,000 gain X 3.8%). Total taxes of $238,000 would leave them with $862,000 of proceeds net of taxes – a tax nightmare.

Your Child and Child’s Spouse Sell the Home 2 Years Later at a Gain. If your child and their spouse sell that home without making any capital improvements for $1,100,000 after 2 years or more, based on their income and meeting the Eligibility Test, they would be subject to long term capital gains taxes of $100,000 ($1,100,000 selling price – $100,000 cost basis = $1,000,00 gain – $500,000 capital gain exclusion = $500,000 gain X 20%).plus NIIT of $19,000 ($500,000 gain X 3.8%). Total taxes of $119,000 would leave them with $981,000 of proceeds net of taxes – a tax nightmare.

Conclusion

By gifting your home to your child and child’s spouse for $600,000 (with a $100,000 costs basis) and meeting the Eligibility Test, you forego a $500,000 capital again exclusion – a tax nightmare. Your child and child’s spouse do not receive a $600,000 cost basis, subjecting them to more taxes when they sell that home – a tax nightmare. Two tax nightmares are always worse than one tax nightmare.

Action Steps

Work closely with your Registered Investment Adviser (RIA) to reduce your taxes, and grow and preserve your wealth.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA) is CEO of Skloff Financial Group, a Registered Investment Advisory firm specializing in financial planning, investment management and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.