How the Government Pension Offset (GPO) Affects Social Security Benefits

Money Matters – Skloff Financial Group Question of the Month – November 1, 2022

By Aaron Skloff, AIF, CFA, MBA

Q: I read the articles ‘What Is the Best Age to Claim Social Security Benefits?’ Part 1, Part 2 and ‘What Is the Best Age to Claim Spousal Social Security Benefits?’ and ‘What Is the Best Age to Claim Survivor Social Security Benefits?’ Part 1 and Part 2. How does the Government Pension Offset (GPO) affect Social Security benefits?

The Problem – Your Spousal or Survivor Social Security Benefits Could be Reduced by the Pension Offset (GPO)

If you have a pension from a state or local government and the job was not covered by Social Security (you did not pay Social Security taxes), the benefits your claim on your spouse (spousal benefit) or deceased spouse (survivor benefit) could be reduced. Those most likely to be affected include educators, police officers and firefighters.

The Solution – Understanding How Spousal or Survivor Social Security Benefits Could be Reduced by the GPO

Under the GPO, your spousal or survivor benefits are reduced by two-thirds of your own pension. Translation: the GPO lowers benefits by $2 for every $3 you receive from your own pension.

Spousal Benefits. Let’s look at an example of a couple, Sue and Bill. Sue has a non-covered (since she did contribute to Social Security) Teacher’s Retirement System (TRS) pension of $3,000 per month. Sue’s spouse, Bill, has a $2,400 per month Social Security benefit that he claimed at his full retirement age (FRA) of 67. Sue can calculate her spousal benefit by reducing her pre-GPO spousal benefit by the GPO to determine her actual spousal benefit. The GPO is 2/3 of Sue’s $3,000 monthly pension, or $2,000. Sue’s spousal benefit pre-GPO would be 50% (if born in 1960 or later and age 67) of Bill’s $2,400 monthly Social Security benefit, or $1,200. Since reducing the pre-GPO spousal benefit of $1,200 by the GPO of $2,000 is $0 or less, Sue’s actual spousal benefit would be $0. See the calculation below.

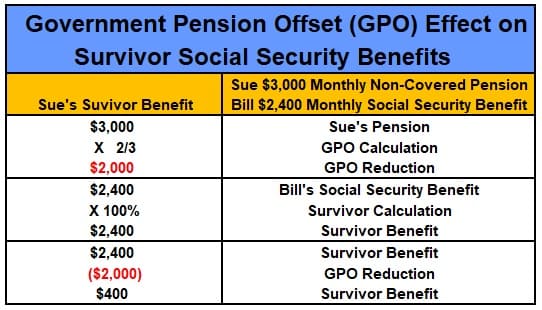

Survivor Benefits. Let’s look at an example of the same couple, Sue and Bill. Bill dies after taking his Social Security benefit at his FRA. The GPO calculation is the same. Sue can calculate her survivor benefit by reducing her pre-GPO survivor benefit by the GPO to determine her actual survivor benefit. Sue’s survivor benefit pre-GPO would be 100% (if born in 1960 or later and age 67) of Bill’s $2,400 monthly Social Security benefit. After reducing the pre-GPO survivor benefit of $2,400 by the GPO of $2,000, Sue’s actual survivor benefit would be $400. See the calculation below.

Click to Enlarge

Click to Enlarge

Often Overlooked. Although the surviving spouse is subject to the GPO on survivor benefits they receive, the surviving spouse is not subject to the GPO on a non-covered pension they inherit. The GPO does not apply to foreign pensions. The GPO does not apply if an individual was covered by both eh government retirement system and Social Security throughout their last 60 months (formerly known as the ‘last day’ rule) of federal, state and local government service.

Strategies. If your spouse ‘retires’ and then works their last 60 months with a different employer that has a pension and employees are subject to Social Security taxes (covered), your will not be subject to the GPO for spousal or survivor benefits.

Action Steps – Determine the Best Age to Claim Social Security Benefits Based on Your Wants and Needs

Work closely with your Registered Investment Adviser (RIA) to determine the best age to claim Social Security benefits.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA) is CEO of Skloff Financial Group, a Registered Investment Advisory firm. He can be contacted at www.skloff.com or 908-464-3060.