How To (Legally) Avoid Taxes When Selling Your Home – Part 1

Money Matters – Skloff Financial Group Question of the Month – June 1, 2024

By Aaron Skloff, AIF, CFA, MBA

Q: We are ready to sell our home and are worried about paying taxes on our gain. What are the key tax considerations we should consider?

The Problem – Death and Taxes

On November 13, 1789, Benjamin Franklin wrote, “Our new Constitution is now established, everything seems to promise it will be durable; but, in this world, nothing is certain except death and taxes.” Little did he know that in 2024, he would be wrong on “taxes”.

Are You Interested in Learning More?

The Solution – How To (Legally) Avoid Taxes When Selling Your Home

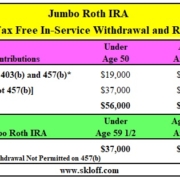

Background. Based on your income and tax filing status, gains on the sale of assets are subject to capital gains taxes. Gains on assets owned for 1 year or less are taxed at your income tax rate. Gains on assets owned for over 1 year are taxed at your long term capital gains tax rate. Additionally, gains may be subject to an investment investment surtax, the Net Investment Income Tax (NIIT). There are additional tax benefits on gains on the sale of your home. See the chart below.

Prior to 1997, homeowners were subject to capital gains taxes on the sale of their home unless they purchased a home of equal or greater value. Since the passage of the Taxpayer Relief Act of 1997 (TRA97), homeowners can exclude capital gains taxes on the sale of their home, subject to numerous terms and conditions.

According to the IRS, “If you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from your income, or up to $500,000 of that gain if you file a joint return with your spouse.” (IRS, Topic Number 701)

Does This Sound Too Good to Be True?

When examining the tax code, if it sounds too good to be true, it probably is too good to be true. To determine if you are eligible for the maximum exclusion gain of $250,000 for a single filer or $500,000 for a married couple filing jointly, you must pass an Eligibility Test. (See IRS Publication 523). Beyond two uncommon automatic disqualifications, you must meet two requirements, ownership and residence.

Ownership. If you owned the home for at least 24 months (2 years) out of the last 5 years leading up to the date of sale (date of the closing), you meet the ownership requirement. For a married couple filing jointly, only one spouse has to meet the ownership requirement.

Residence. If you owned the home and used it as your primary residence for at least 24 months of the previous 5 years, you meet the residence requirement. The 24 months of residence can fall anywhere within the 5-year period, and it does not have to be 24 sequential months or a single block of time. All that is required is a total of 24 months (730 days) of residence during the 5-year period. Unlike the ownership requirement, each spouse must meet the residence requirement individually for a married couple filing jointly to get the full exclusion.

Short Term Gain, Long Term Gain or Long Term Gain And Capital Gains Exclusion. Before selling your home, consider your capital gains tax implications. If you sell your home after owning it for 1 year or less, your gain is taxed at your income tax rate. See the red (danger zone) section of the chart below. Additionally, you may be subject to the investment surtax based on your income. If you sell your home after owning it for more than 1 year, but less than 2 years, your gain is taxed at your long term capital gains tax rate based on your income. See the yellow (safe zone) section of the chart below. Additionally, you may be subject to the investment surtax based on your income. If you sell your home after owning it for 2 years or more, your gain of up to $250,000 for a single filer or $500,000 if married filing jointly can be excluded from your capital gains. See the green (ultra safe zone) section of the chart below. Gains in excess of the exclusion amount are subject to long term capital gains taxes. Additionally, you may be subject to the investment surtax based on your income.

Click to Enlarge

Action Steps

Work closely with your Registered Investment Adviser (RIA) to reduce your taxes, and grow and preserve your wealth.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA) is CEO of Skloff Financial Group, a Registered Investment Advisory firm specializing in financial planning, investment management and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.