Long Term Care Insurance Return of Premium – Long Term Care University – 04/15/10

Long Term Care University – Question of the Month – 04/15/10

Research

By Aaron Skloff, AIF, CFA, MBA

Q: What happens if I pay for long term care insurance for the rest of my life, pass away, and never use the benefits of my policy? Will my heirs receive a fund of the premiums I paid?

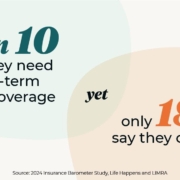

The Problem – Paying Your Premium and Never Using the Benefits

That’s a good problem to have. It’s like paying your homeowners insurance for 50 years and never seeing your house burn down. Like all insurance, you hope you never need the benefits of the policy. The idea of peacefully going to sleep at the age of 95 and never waking up again, without ever needing long term care, is a dream come true for many people. But, you may prefer receiving some benefit from long term care insurance – even if the benefit goes to your heirs.

The Solution – Return of Premium Benefit

Return of Premium. Some long term care insurance policies include or provide the option to add a return of premium benefit. The insurance company pays your heirs all the premium payments you have made, less any long term care benefits paid against the policy. Some return of premium benefits are included in the policy if you pass away prior to age 65.

Enhanced Return of Premium. Some long term care insurance policies allow you to purchase a rider that enhances your built-in return of premium benefit, beyond the age of 65. With the enhanced return of premium benefit, your heirs receive a benefit equal to your total premiums paid, less any long term care benefits paid against the policy, regardless of your age.

Let’s look at an example. You pay $2,000 each year for 30 years, for a total of $60,000. You are fortunate, because you pass away without ever having used the policy. You heirs are also fortunate, as they will receive a check from the insurance company for $60,000.

Graded Return of Premium. Some long term care insurance policies allow you to purchase a rider that will return a percentage of your premium paid, less any claims paid against the policy. The percentage is dependent upon your age when you pass away. It starts at 100% and begins decreasing by 10% each year after the age of 65, until at age 75, when the percentage decreases to zero.

10-Year Return of Premium. Some long term care insurance policies allow you to purchase a rider that will return all of your premiums paid, less any claims paid against the policy. If you have been insured for at least 10 years when you pass away, and you have never filed a claim, the insurance company will return your full premium paid. If you have filed a claim, the insurance company will return your premium paid less any claims paid against the policy.

Action Step – Protect Yourself with a Return of Premium Benefit

When you purchase a long term care insurance policy with a return of premium benefit you remove any risk of not gaining any benefits from the policy – even if it is your heirs who reap the benefits.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA) charter holder, Master of Business Administration (MBA), is the Chief Executive Officer of Skloff Financial Group, a NJ based Registered Investment Advisory firm. The firm specializes in financial planning and investment management services for high net worth individuals and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.