Long Term Care Insurance Tax Advantages – Long Term Care University

Long Term Care University – Question of the Month – 04/15/13

By Aaron Skloff, AIF, CFA, MBA

Q: Can long term care insurance be offered as a company benefit to all or a limited number of our employees? If so, are there any tax advantages for employers or employees? Are there still tax advantages for individuals who purchase a policy on their own?

The Problem – Attracting and Retaining Valuable Employees with Competitive Compensation

A company’s success or failure is oftentimes determined by the quality of its employees. Let’s look at the example of surgeons. Although surgeons have access to the same scalpels, it is the quality of their procedure, not the actual scalpel that determines the outcome – oftentimes, your life or death. Offering an attractive benefits package can be a key element in attracting and retaining the highest quality employees. Employees seek out benefits packages that offer a competitive salary, health insurance, retirement plan and long term care insurance. Both employers and employees recognize the hidden costs of giving long term care (interruptions and decreased productivity), as well as the staggering costs of long term care.

Click Here for Your Long Term Care Insurance Quotes

The Solution – Offer Long Term Care Insurance as a Company Benefit to Employees

Whether the business is a sole proprietor or multi-national corporation, long term care insurance can be offered as a company benefit. Unlike most company benefits, which prohibit the employer from discriminating, long term care insurance can be offered on a limited basis to certain employees (e.g.: only salaried employees) or on an unlimited basis at the company’s discretion. Employees of companies with multiple participants can receive simplified underwriting for themselves and their family members, portable coverage if they leave the employer and group discounts. Clearly understand the tradeoffs of reduced underwriting.

Tax Advantages for Employers

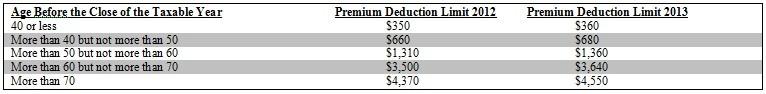

C corporations can deduct the full amount of tax qualified long term care insurance premiums paid for employees, their spouses and dependents as a business expense. Sole proprietors (e.g.: consultants), partnerships, limited liability corporations (LLCs) and S corporations can follow the same guidelines with deductions limited to the full eligible amount (limited to the chart below).

Tax Advantages for Employees or Individuals Purchasing Their Own Policy

Employees who pay all or a portion of the tax qualified long term care insurance premiums for themselves, spouses and dependents (and individuals purchasing their own policy) may be able to deduct all or a portion of the premium on their federal income tax return. Employees and individuals purchasing their own policy living in certain states may also be eligible for either tax credits or deductions for premiums they pay. For example, New York State provides a 20% tax credit.

Employees and individuals purchasing their own policy can add the tax qualified premium (limited to the chart below) to other medical expenses (health and dental insurance premiums, insurance co-payments, out-of-pocket prescription costs, and other unreimbursed medical expenses). Amounts in excess of 10% of adjusted gross income (AGI) can be itemized as a medical expense deduction on Schedule A of Form 1040 of federal income tax return. Amounts in excess of 7.5% of AGI can be itemized for any year between 2013 and 2016 that you are 65 years of age or older. (IRC §213(a)).

Click to Enlarge

Action Step – Offer Long Term Care Insurance as a Company Benefit to Employees and Take Advantage of Tax Benefits

Whether you are a sole proprietor, the benefits director of a mid sized LLC or the CEO of a multi-national corporation, implementing long term care insurance as an employee benefit can have tremendous qualitative and quantitative benefits. Request your insurance consultant provide you quotations from multiple vendors before choosing a plan.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA) charter holder, Master of Business Administration (MBA), is the Chief Executive Officer of Skloff Financial Group, a Registered Investment Advisory firm. The firm specializes in financial planning and investment management services for high net worth individuals and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.