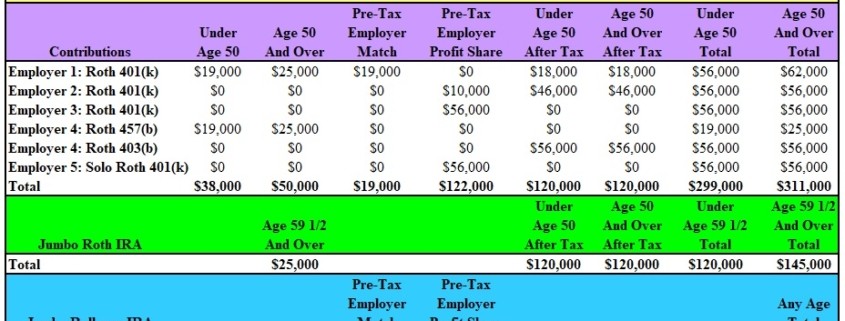

Maximizing Contributions to Multiple Employer Retirement Plans 2019

Click to Enlarge

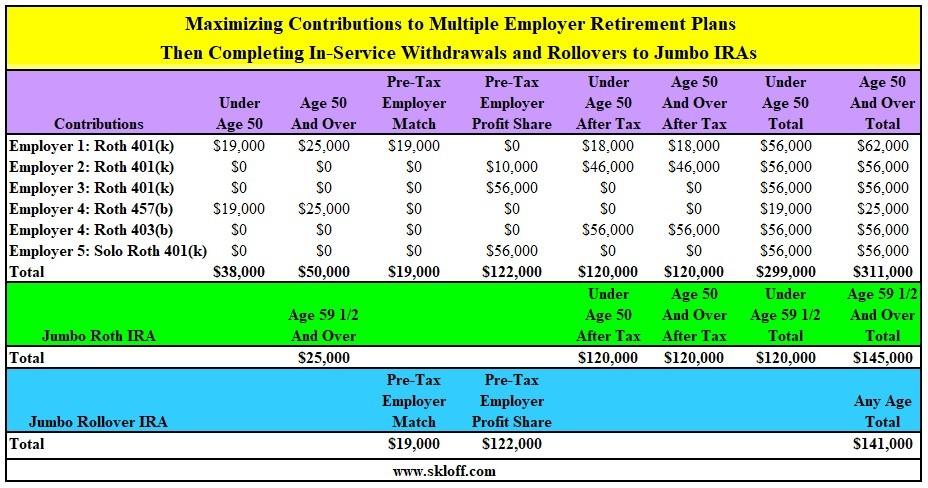

Maximizing Contributions to Multiple Employer Retirement Plans

Then Completing In-Service Withdrawals and Rollovers to Jumbo IRAs

The IRS allows you to contribute to multiple employer retirement plans. The IRS places an $19,000 annual limit ($25,000 if age 50 or over) on employee contributions (elective deferrals) cumulatively across 401(k)s and 403(b)s and the same limits cumulatively across 457(b)s. It also places a $56,000 limit ($62,000 if age 50 or over) on the combination of employee elective deferrals, employer contributions and employee after tax contributions . As along as the employers are unrelated and not a controlled group (a parent-subsidiary employer that owns 80% of another employer or a brother-sister employer with five or fewer owners with a controlling interest in another employer), the limits are per employer. You can have multiple employer retirement plans with $53,000 cumulative contribution limits and one with $59,000.

Create Jumbo IRAs with In-Service Withdrawals and Rollovers

After maximizing contributions, you can then complete a tax free in-service withdrawal and rollover of the after tax portion if under age 59 ½ to a Roth IRA , or Roth 401(k) and after tax contributions if age 59 ½ and over, if your employer offers this option. And you can complete a tax free in-service withdrawal and rollover of employer contributions to a Rollover IRA at any age, if the employer offers this option.

Fortunately, you can repeat this process every year. This chart summarizes the process.

Click Here for Your Long Term Care Insurance Quotes