Medicare Basics – What You Need to Know – 08/01/18

Money Matters – Skloff Financial Group Question of the Month – August 1, 2018

By Aaron Skloff, AIF, CFA, MBA

Q: Can you provide us a basic understanding of Medicare? What do we need to know?

A: The Problem — Understanding Basic Federal Programs are Not Always Basic

Think of Medicare like Swiss cheese – it appears solid on the surface, but it is full of holes. To make better choices and avoid hefty out-of-pocket costs, read below to gain a better understanding of Medicare.

The Solution — Medicare Basics

Medicare is the federal health insurance program for people who are 65 or older and certain younger people with disabilities. Medicare has four parts: Parts A, B, C and D. Part A and B are called Original Medicare. Let’s review each part below.

Part A. Part A is often called Hospital Insurance. About 99% of people can enroll in Part A at no cost because they or a spouse paid Medicare taxes while working in the United States for 40 or more quarters. If you buy Part A, you’ll pay up to $422 each month in 2018. It covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. Cost sharing includes: inpatient hospital deductible of $1,340, daily coinsurance for 61st-90th day of $335, daily coinsurance for lifetime reserve days of $670 and skilled nursing facility coinsurance of $167.50 under very limited circumstances.

Long-term care is a range of services and support for your personal care needs. Most long-term care isn’t medical care. Instead, most long-term care is help with basic personal tasks of everyday life, sometimes called activities of daily living. Medicare doesn’t cover long-term care (also called custodial care), if that’s the only care you need. Most nursing home care is custodial care.

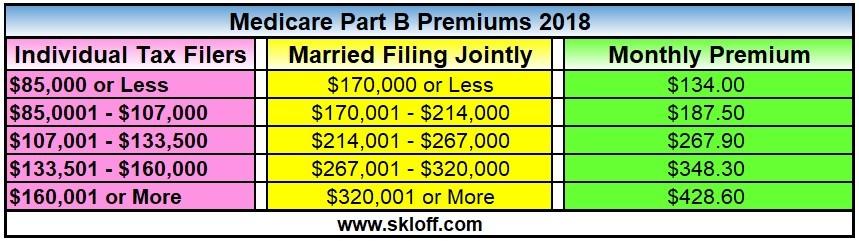

Part B. Part B is often called Medical Insurance. It covers medical care, including doctor and other health care providers’ services and outpatient care. Part B also covers durable medical equipment, home health care, and some preventive services. You pay $183 per year for your Part B deductible. After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you’re a hospital inpatient), outpatient therapy, and durable medical equipment. Premiums are based on your income (reported on your tax return two years ago) as seen in the table below.

Part C. Part C is oftentimes called Medicare Advantage (MA). The plans are offered by private companies approved by Medicare. If you join a MA Plan, you still have Medicare. You’ll get your Medicare Part A (Hospital Insurance) and Medicare Part B (Medical Insurance) coverage from the MA Plan. Most MA Plans also offer extra coverage, like vision, hearing, dental and drug coverage. Each MA Plan can charge different out-of-pocket costs that have different rules for how you get services, like: whether you need a referral to see a specialist or if you must go to doctors, facilities, or suppliers that belong to the plan for non-emergency or non-urgent care.

Part D. Part D is also called the Medicare Prescription Drug Coverage. You can purchase the Part D plan, with premiums based on your income. Like Part B – the higher your income, the higher your premium. Or, you can choose a Medicare Advantage Plan that offers drug coverage. Each Medicare drug plan has its own list of covered drugs (called a formulary). Drugs are placed in “tiers” that determine their cost.

Medigap. Medigap is oftentimes called Medicare Supplement Insurance. Medigap policies are sold by private companies and help pay some of the costs that Part A and Part B do not cover, like: copayments, coinsurance and deductibles. You cannot own a Medicare Advantage Plan and a Medigap policy. There are a host of plans with various copays and deductibles, named: A, B, C, D, F, G, K, L, M and N.

Action Steps

Since there are various enrollment deadlines and penalties if those enrollment deadlines are not met, conduct your research well before your deadline. Evaluate what parts to enroll in based on your unique needs.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA) is CEO of Skloff Financial Group, a Registered Investment Advisory firm. He can be contacted at www.skloff.com or 908-464-3060.