National Guardian Life EssentialLTC Long Term Care Insurance Review – Long Term Care University

Long Term Care University – Question of the Month – 05/15/18

By Aaron Skloff, AIF, CFA, MBA

Q: We read the Long Term Care University article that compares Traditional to Combination Life and Long Term Care (LTC) Insurance and prefer the Traditional LTC policy. Can you please review the National Guardian Life EssentialLTC Traditional LTC policy?

Overview. National Guardian Life Insurance Company is an A.M. Best A- rated, 109-year-old company. The EssentialLTC policy is a Traditional Long Term Care Insurance policy. Traditional Long Term Care Insurance policies provide the highest level of LTC benefits for the lowest premiums and can be designed to meet Long Term Care Partnership Program requirements to protect your assets away from Medicaid.

Click Here for Your Long Term Care Insurance Quotes

National Guardian Life EssentialLTC is Unique Because It Provides Lifetime Benefits. One of the largest long term care insurance companies reported that 50% of all claims dollars it has paid are due to dementia, including Alzheimer’s disease. According to the Alzheimer’s Association, 1 in 9 people ages 65 and older and about 1 in 3 people ages 85 and older have Alzheimer’s disease. The duration of Alzheimer’s disease is generally four to eight years after a diagnosis but can last as long as 20 years.

Most insurance companies mitigate their own risks by limiting coverage to five or six years of care. EssentialLTC offers lifetime benefits with an unlimited number of years of care and an unlimited dollar amount of total LTC benefits.

National Guardian Life EssentialLTC is Unique Because It Offers Shared Care with an Additional Third Shared Pool of Benefits. Most long term care insurance policies are designed as individual policies that insure one person. Unfortunately, you may need more care than your individual policy covers. Your spouse would not be able to give you any of their benefits. Shared care policies provide extra protection if you need more care. Most shared care policies allow spouses to use each other’s benefits when one person consumes all their benefits. But, this could leave one spouse with insufficient benefits when they need care. For example, if a couple each purchased a $150 daily benefit with five years of care, they would each have $273,750 in benefits or $547,000 in total benefits, in year 1.

National Guardian Life EssentialLTC’s shared care has an additional third shared pool of benefits. For example, if a couple each purchased a $150 daily benefit with five years of care, they would each have $273,750 in benefits or $547,000 in total benefits, in year 1. They would also have a third shared pool of $273,750 either can use. Their total benefits including the third shared pool of benefits would be $821,250, in year 1. Thus, protecting each spouse’s benefits, while offering 50% more total combined benefits.

National Guardian Life EssentialLTC Options. The policy options include: Payment options of lifetime, 10 pay or 1 pay (single pay); Benefit periods of 2-6 years or lifetime (unlimited number of years); Inflation protection of none, 3% compound, 5% compound; Elimination period of 0, 30, 90 or 180 days; Reimbursement based benefit payment method; Shared care with third shared pool of benefits; Full or limited return of premium (available with or without optional policy surrender). Policy surrender anniversary schedule of 20% first, 40% second, 60% third, 80% fourth.

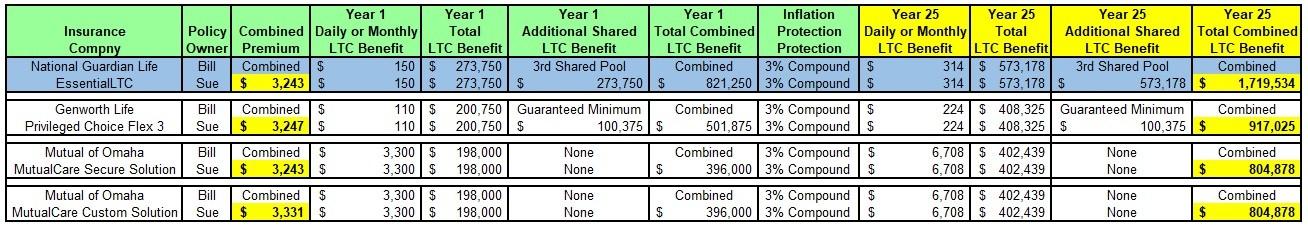

How National Guardian Life EssentialLTC Compares with Other Traditional LTC Policies. Let’s look at a husband and wife, Bill and Sue, who are each 55 years old, reside in New Jersey and expect to need LTC in 25 years at the age of 80. They are comparing Traditional policies with a combined annual premium of approximately $3,200 with 3% compound inflation protection included in the premium, 90 day elimination, 5 years of care each, shared care and prefer the largest total combined LTC benefits (highlighted in blue in the chart below).

National Guardian Life EssentialLTC Outperforms Competitors with the Highest Daily Benefits and the Highest Total Combined LTC Benefits. Bill and Sue will each will have $314 daily and $1,719,534 total combined LTC benefits. Genworth Life Privileged Choice Flex 3 is a strong alternative due to its guaranteed minimum additional shared LTC benefit. Mutual of Omaha MutualCare Secure Solution and Mutual of Omaha MutualCare Custom Solution are notable for their monthly benefit and partial cash benefit payment method.

Click to Enlarge

Action Steps and Conclusions. Compare each company’s total combined LTC benefits. National Guardian Life EssentialLTC provides high daily and total combined LTC benefits. Since premiums vary greatly based on age, health and marital status, request individualized quotes.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA) charter holder, Master of Business Administration (MBA), is the Chief Executive Officer of Skloff Financial Group, a Registered Investment Advisory firm. The firm specializes in financial planning and investment management services for high net worth individuals and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.

Click Here for Your Long Term Care Insurance Quotes

National Guardian Life Insurance Company is not affiliated with the Guardian Life Insurance Company of America, a.k.a The Guardian or Guardian Life.