Not All Hybrid Life and Chronic Illness and Long Term Care Insurance Policies Are The Same – Part 1 – Long Term Care University

Long Term Care University – Question of the Month – 11/15/22

By Aaron Skloff, AIF, CFA, MBA

Q: We read the Long Term Care University article that compares ‘Traditional Versus Hybrid Life and Long Term Care Insurance’ and prefer the Hybrid Long Term Care Insurance (LTC) policy. The article focuses on Hybrid policies with a multiple of LTC benefits to death benefit. We want to a Hybrid policy that provides an equal amount of care and death benefit. What type of policies are available?

Overview. Hybrid Life and Chronic Illness and Hybrid Life and LTC Insurance policies provide guaranteed benefits and guaranteed premiums. The insurance company either: 1) pays you if you need care, 2) pays your heirs if you do not need care, or 3) pays you and your heirs if you need a modest amount of care.

Click Here for Your Long Term Care Insurance Quotes

The Problem – Not All Hybrid Life and Chronic Illness, and Hybrid Life and Long Term Care Insurance Policies are the Same

Although most Hybrid Life policies appear the same on the surface, there are many differences. We focus on the key differences below.

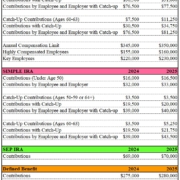

No Upfront Cost Hybrid Life and Chronic Illness Insurance Policy. Unlike a care benefit that you pay for, with this type of policy you ‘pay’ for the care benefit in the form of a benefit discount when you file a claim. For example, you may submit a claim for $100,000 of care and only receive a $50,000 benefit due to a discount factor based on interest rates and your life expectancy. Furthermore, with some policies, your death benefit could be reduced by up to $8 for each $1 of care benefits you receive. See the chart below.

Paid Hybrid Life and Chronic Illness Insurance Policy. While you a pay recurring chronic illness rider charge, you care benefit is fixed at a percentage of your death benefit. For example, you may submit a claim for $100,000 of care and receive a $100,000 benefit – reducing your death benefit by $1 for each $1 of care benefits you receive, or $100,000. See the chart below.

Paid Hybrid Life and Long Term Care Insurance Policy. While you a pay recurring LTC rider charge, you care benefit is fixed as a percentage of your death benefit. For example, you may submit a claim for $100,000 of care and receive a $100,000 benefit – reducing your death benefit by $1 for each $1 of care benefits you receive, or $100,000. Plus, there is required consumer protection. See the chart below.

Click to Enlarge

The Solution – Purchase a Hybrid Life and Chronic Illness or Hybrid Life and LTC Insurance Policy That Meets Your Needs

As highlighted in the chart above, if you want your insurance company to determine your care benefits, choose a no upfront cost policy. If you want a fixed care benefit, choose either a paid chronic illness or paid long term care rider on you Hybrid Life Insurance policy.

Action Steps. Since premiums vary greatly based on type of riders, age, health and marital status, request individualized quotes.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA) charter holder, Master of Business Administration (MBA), is the Chief Executive Officer of Skloff Financial Group, a Registered Investment Advisory firm. The firm specializes in financial planning and investment management services for high net worth individuals and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.