Professionally Managed 401(k) Accounts Can Generate 3% to 4% Higher Returns Per Year

Money Matters – Skloff Financial Group Question of the Month – January 1, 2026

By Aaron Skloff, AIF, CFA, MBA

Q: Our 401(k) accounts represent a significant portion of our assets and are our largest retirement accounts. What are the advantages of having our 401(k) accounts professionally managed?

The Problem – Getting Professional Advice to Optimize Return and Risk in Your 401(k) Account

Charles Schwab’s ‘2024 401(k) Participant Study’ found 61% of retirement savers believe their financial situation warrants professional advice, compared with 55% in 2023.

The Solution – Professional Managed 401(k) Accounts Can Generate 3% to 4% Higher Returns Net of Fees Per Year

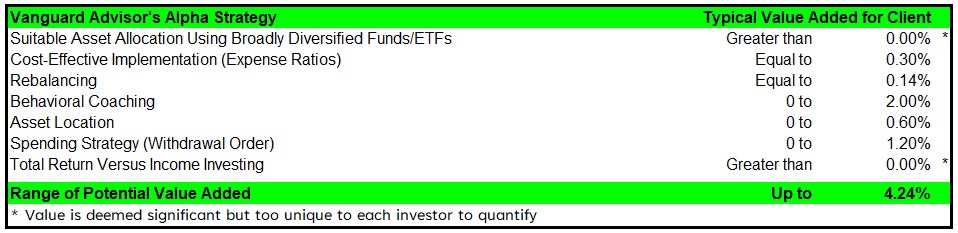

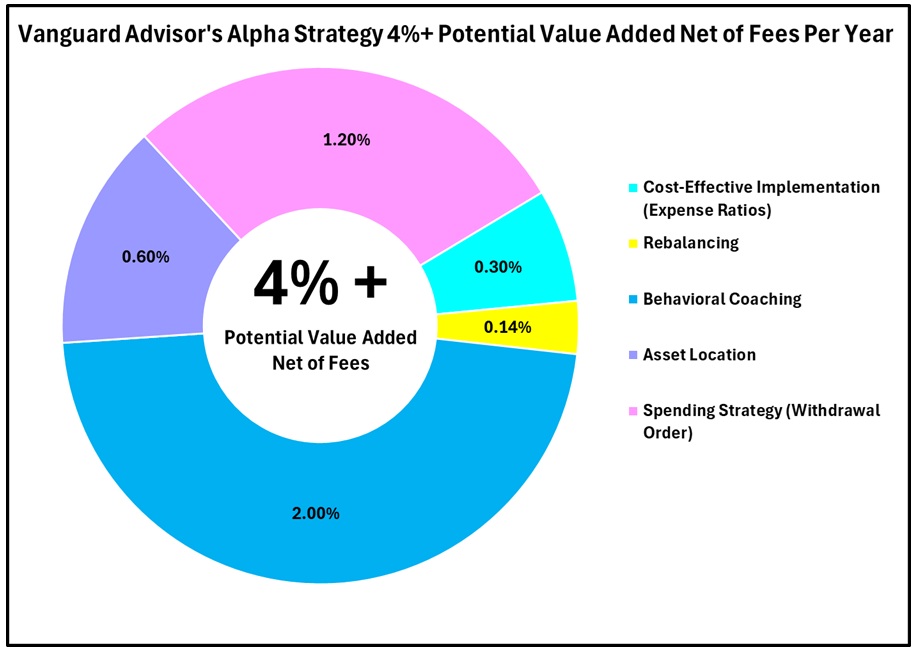

Vanguard’s 2022 ‘Putting a Value on Your Value: Quantifying Vanguard Advisor’s Alpha’ study concluded that professionally managed accounts can add 3% to 4% higher returns net of fees per year.

The Vanguard study attributed the higher performance to the following components. See the table and chart below.

Click to Enlarge

Have Your 401(k), 403(b), 457(b) Account Professionally Managed

As seen in the table above, Suitable Asset Allocation is deemed significant. According to Vanguard, “a whopping 88% of your experience (the volatility you encounter and the returns you earn) can be traced back to your asset allocation”.

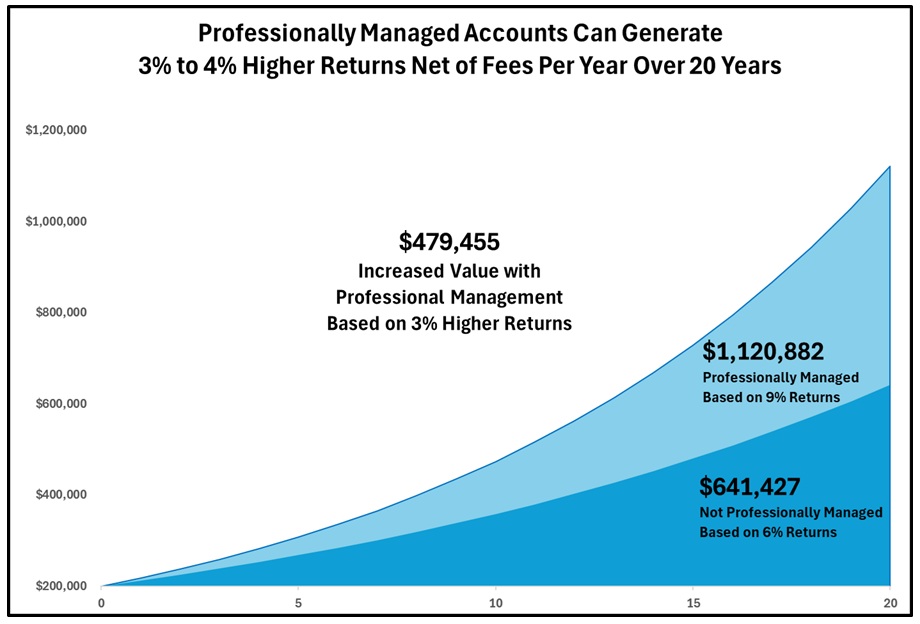

Professionally Managed Accounts Can Generate 75% Higher Values Over 20 Years. Applying Vanguard’s study, 3% higher returns per year can generate a 75% higher account value over 20 years. Let’s look at an example of a $200,000 401(k) account that is not professionally managed, based on 6% annual returns. Over 20 years, the account that is not professionally managed grows to $641,427. Let’s look at an example of a $200,000 401(k) account that is professionally managed, based on 9% annual returns net of fees. Over 20 years, the professionally managed account grows to $1,120,882. The professionally managed account has a $479,455 higher value, equating to a 75% higher value. See the chart below.

Click to Enlarge

Click to Enlarge

Action Steps

Optimize the return and risk in your 401(k) account by having it professionally managed. A professionally managed 401(k) account can generate 3% to 4% higher returns net of fees per year, resulting in a 75% higher account value over 20 years.

Work closely with your Registered Investment Adviser (RIA) to professionally manage your 401(k) account.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA) is CEO of Skloff Financial Group, a Registered Investment Advisory firm specializing in financial planning, investment management and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.

Have Your 401(k), 403(b), 457(b) Account Professionally Managed