Pros And Cons of Long Term Care Insurance – Long Term Care University

Long Term Care University – Question of the Month – 12/15/14

By Aaron Skloff, AIF, CFA, MBA

Q: What are the pros and cons of Long Term Care Insurance?

The Problem – Facts Versus Myths About Long Term Care

Many people believe the myth that major medical health insurance will pay for long term care services or that Medicare will pay for it in their later years. In fact, neither major medical health insurance nor Medicare covers traditional “custodial care.” Custodial care includes the basic activities of daily living: bathing, feeding, dressing, getting in or out of bed or off and on a chair, moving around and using a bathroom. Medicare will cover care in a skilled nursing facility or pay for skilled home health care services only when medically necessary, such as following an inpatient hospital stay.

Click Here for Your Long Term Care Insurance Quotes

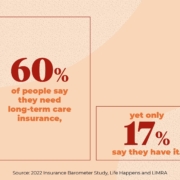

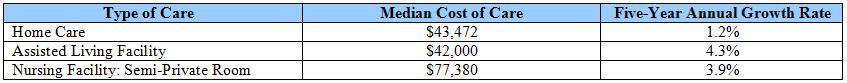

Like many, you may believe the myth that you are healthy today so you will not need long term care in the future. In fact, there is a 7 in 10 risk you will need long term care if you live past the age of 65. You may believe the myth that only facility care is expensive. In fact, most long term care costs are quite expensive, as evidenced by the table below.

Like many, you may believe the myth that you are healthy today so you will not need long term care in the future. In fact, there is a 7 in 10 risk you will need long term care if you live past the age of 65. You may believe the myth that only facility care is expensive. In fact, most long term care costs are quite expensive, as evidenced by the table below.

Click to Enlarge

Based on the data above, if a husband and wife each needed 3.5 years of home care (the average length of home care) and no further care thereafter at home or in a facility, it would cost them a combined $304,304. If they did not need the care for 18 years and the cost of care grew at 4% per year the cost would double to a combined $608,608.

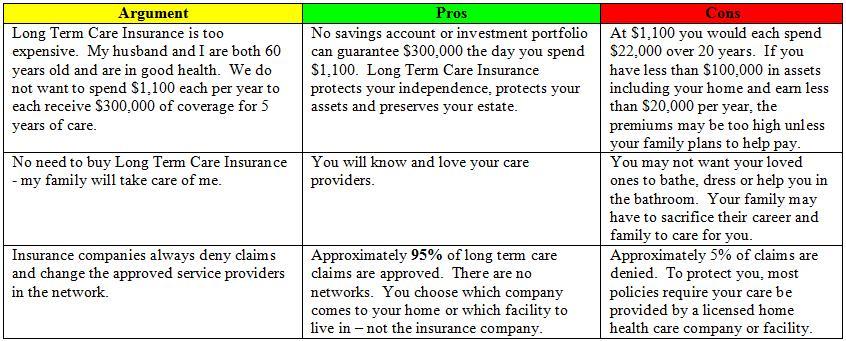

The Solution – Understanding the Pros and Cons of Long Term Care Insurance

From automobile to homeowners insurance, there are pros and cons for all types of insurance. Let’s look at the top pros and cons below.

Click to Enlarge

Action Step – Obtain Personalized Quotes Then Weigh the Pros and Cons of Long Term Care Insurance

Obtain personalized quotes from at least three or four long term care insurance companies based on your health, age, marital status and customized benefits. Simply changing one of the previous variables or just the insurance company can double your premium. After reviewing the quotes along with the pros and cons, decide if Long Term Care Insurance is right for you.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA) charter holder, Master of Business Administration (MBA), is the Chief Executive Officer of Skloff Financial Group, a Registered Investment Advisory firm. The firm specializes in financial planning and investment management services for high net worth individuals and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.

Click Here for Your Long Term Care Insurance Quotes