Retirement Savings – Now or Later

Money Matters – Skloff Financial Group Question of the Month – September 1, 2017

By Aaron Skloff, AIF, CFA, MBA

Q: I want to save for retirement. Should I save a smaller amount today or wait until I’m older and save a larger amount?

The Problem – Retirement Savings – Now or Later

Many of us face a host of current expenses, including: mortgage, rent, health insurance, groceries, dining out, travel and entertainment. It is all too easy to spend all your earnings on current expenses instead of saving for retirement. It is also easy to convince yourself you will simply save a larger amount later. This can be a big mistake. Even if you are disciplined enough to save a larger amount later, you may not be able to recoup for the lost time.

The Solution – Slow and Steady Now Wins the Race

Benjamin Franklin published a column titled ‘Hints For Those That Would Be Rich’. In it he wrote, “A penny saved is two pence clear.” Translation: if you save your money you can double it (or a penny saved is two pennies earned). Albert Einstein once said, “Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t…pays it.” Compounding allows an investor to earn interest on interest or earnings on earnings.

Have Your 401(k), 403(b), 457(b) Account Professionally Managed

Modern retirement savings accounts, like: 401(k)s, 403(b)s, 457(b)s, IRAs, Roth IRAs, SEP IRAs and SIMPLE IRAs provide savers tax sheltered growth and in some cases tax free withdrawals. When applied in a slow and steady manner, you can win the retirement savings race. One of the best ways to create a disciplined retirement savings plan is through regular payroll deductions.

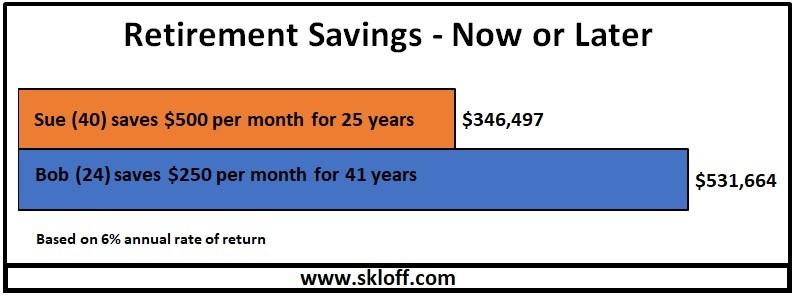

Numbers Speak Louder Than Words. Let’s look at an example of two retirement savers. Bob is 24 years old and chooses to invest $250 per month until he retires at the age of 65. At the age of 24, Sue decides to delay saving until she was 40 and would save $500 per month until she retired at the age of 65. Through the power of diligent savings and earning a 6% annual rate of return on a compound basis, both build respectable retirement savings accounts. Please see the chart below.

Despite Sue savings twice as much as Bob, Bob wins the retirement savings race with a $531,664 ending balance. Sue’s ending balance is $346,497. Bob gained the benefit of a slow and steady savings approach along with the power of his earnings compounded upon themselves for a longer period of time than Sue. He amassed over 53% greater savings than Sue when they each retired at 65.

Click to Enlarge

Action Steps – Save for Retirement Now

Save steadily through regular payroll deductions. Saving a smaller amount now can create a larger retirement savings account than delaying and trying to makeup from lost time through larger contributions. Make time and compound interest work for you.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA) is CEO of Skloff Financial Group, a Registered Investment Advisory firm specializing in financial planning, investment management and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.

Have Your 401(k), 403(b), 457(b) Account Professionally Managed