The Cost of Care – Planning to Afford the Unknown

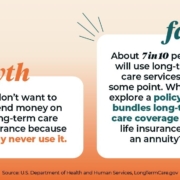

Long-term care insurance is designed to pay for or reimburse the costs of long-term care.

Linda’s plan covers up to $8,000 a month, which is more than 90% of Paul’s memory care center costs.

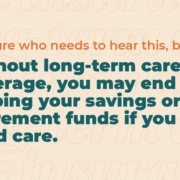

“If we didn’t have long-term care, we’d be pulling from his and my retirement accounts and at a young age,” Linda said. “If we were 90, that would be one thing, but I’m planning on living to a ripe old age after we’re done with this journey, and we would decimate the accounts without this.”

Long-term care insurance can cover most skilled nursing homes, home care coverage and residential-type care facilities, among other things.

Source: ABC News 10 San Diego

Click Here for Your Long Term Care Insurance Quotes