The Cost of Missing Out

Click to Enlarge

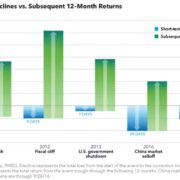

The Cost of Missing Out

Research has shown that missing out on the best trading days has a huge impact on long-term returns, as they often follow the worst days. Using market data going back to 1930, Bank of America found that an investor who missed the S&P 500 index’s best 10 days each decade would have a return of 91% compared to a 14,962% return for those who stayed invested.

Source: CNBC