The Protected IRA Plus Plan – Part 3 – 03/01/23

Money Matters – Skloff Financial Group Question of the Month – March 1, 2023

By Aaron Skloff, AIF, CFA, MBA

Q: We read the articles ‘The SECURE Act Brings the Biggest Changes to IRAs Since Their Inception’ Part 1, Part 2, and Part 3, and ‘The SECURE Act 2.0 Brings Big Changes to Retirement Accounts’ Part 1 and Part 2 and Part 3 and ‘The Protected IRA Plus Plan (PIPP)’ Part 1 and Part 2. Can a PIPP provide more net income after taxes, protect our assets from financial market losses, gain protection against long term care expenses and return our assets to our beneficiaries on a tax-free basis?

A: The Problem — Optimizing Taxes after the SECURE Act

If you stretch withdrawals too long on large retirement accounts, you could increase your own tax brackets and your beneficiaries’ tax brackets. The higher your income (including withdrawals and Roth IRA conversions), the higher your: income tax bracket, capital gains rates and qualified dividends rates and probability you will be subject to the investment surtax. IRAs inherited after 12/31/19 must be withdrawn within a mere 10 years (spouses have an exception), potentially increasing beneficiaries’ tax brackets. An unexpected death or need for long term care, 7 in 10 people aged 65 and older will need long term care, could force large withdrawals at high tax brackets.

Click Here for Your Life Insurance Quotes

The Solution – Implement a Protected IRA Plus Plan (PIPP) with the Goal of Maximizing Tax-Free Life Insurance and Tax-Free Chronic Illness or Long Term Care Benefits

The Protected IRA Plus Plan (PIPP) can be customized for various goals. If the goal is to maximize guaranteed lifetime income, you complete a tax-free transfer of a Traditional IRA to a Traditional IRA (in whole or in part) that holds a Single Premium Immediate Annuity (SPIA). The SPIA provides a guaranteed lifetime income by accelerating Traditional IRA withdrawals through substantially equal periodic withdrawals before and during the period when RMDs are required. You can also complete Roth IRA conversions, if creating a tax-free asset is another goal. And, with a portion of the guaranteed lifetime income, you purchase life insurance with long term care (LTC) or chronic illness benefits (Hybrid Life and Long Term Care Insurance), or both.

The insurance policy leverages premiums paid with IRA withdrawals into significantly more tax-free chronic illness or LTC benefits and/or a tax-free death benefit, while protecting the value of the IRA from financial market losses. The PIPP protects your assets from an unexpected death or need for LTC, creates more wealth, reduces (combined) taxes for you and your beneficiaries and maximizes guaranteed lifetime income.

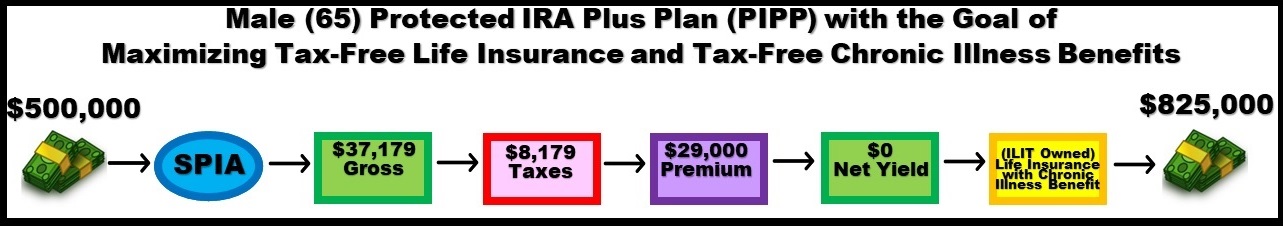

Numbers Speak Louder Than Words. Let us look at an example of a married couple and their son. Harvey (age 65) has a $500,000 Traditional IRA and his wife Myrna (59) does not have any IRAs. If Harvey transfers his Traditional IRA to a Traditional IRA that holds a SPIA, the SPIA will generate $37,179 per year of guaranteed lifetime income (a 7.4% cashflow). Based on their income and joint filing status, they can: maintain an income tax bracket of 12% on some income and 22% on some income, a capital gains and qualified dividends rate of 15% and avoid the 3.8% investment surtax. Harvey can protect his $500,000 asset from financial market losses, an unexpected death or need for LTC by paying $29,000 per year for a $825,000 Hybrid Life and Chronic Illness insurance policy with a guaranteed death benefit and guaranteed care benefit through age 100 – maximizing his benefits.

While Harvey receives $37,179 per year, he pays $8,179 in taxes (assuming a 22% tax rate) and $29,000 in insurance premiums Assuming Harvey lives to age 100: from the age of 65 to 100, Harvey receives $1,338,448 on a pre-tax basis and $1,043,990 on an after-tax basis. If Harvey needs care before passing away, the policy will pay up to $16,500 per month or $8250,000 in total tax-free benefits to pay for his care. If Harvey passes away at any point from age 65 through 100 without needing care, his beneficiaries receive $825,000 on a tax-free basis and on an estate tax free basis (with an Irrevocable Life Insurance Trust (ILIT), if needed). See the flowchart below.

Click to Enlarge

Action Step — Work Closely with a Registered Investment Adviser (RIA) to Review Your Finances

Work closely with an RIA to review your estate, financial and tax plan to determine if you have the best strategies in place to build and protect your wealth. Implement the solutions described above based on your unique circumstances.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA) is CEO of Skloff Financial Group, a Registered Investment Advisory firm. He can be contacted at www.skloff.com or 908-464-3060.