Top 10 Tax Tips Created by the New Tax Law – Part 3

Money Matters – Skloff Financial Group Question of the Month – November 1, 2025

By Aaron Skloff, AIF, CFA, MBA

Q: We read ‘Top 10 Tax Tips Created by the New Tax Law’ Part 1 and Part 2. With the One Big Beautiful Bill (OBBB) signed into law, what are the top 10 tips created by the new law?

The Problem – Extracting Valuable Benefits from the New Tax Law

Extracting valuable tax planning benefits from 870 pages of a new tax law can seem like an insurmountable task.

The Solution – The Top 10 Tax Tips Created by the New Tax Law

Below are the top 10 financial and tax planning tips that can provide you with financial benefits and tax savings for years to come.

Are You Interested in Learning More?

7. Convert to Roth 401(k)s and IRAs

The new tax creates an aged 65+ second additional deduction of $6,000 whether you use the standard deduction or itemize (see Top 10 Tax Tip 4). Utilize the new deduction to convert pre-tax retirement accounts, including 401(k)s and IRAs, to Roth 401(k)s and Roth IRAs while potentially avoiding the impact of a higher income tax bracket. Your adjusted gross income (AGI) includes your wages (after pre-tax retirement account contributions), interest, dividends, capital gains and conversions of pre-tax retirement accounts to Roth accounts. Your modified adjusted gross income (MAGI) includes your AGI plus: pre-tax IRA contributions, municipal bond interest, half of self-employment tax, non-taxable Social Security payments and other adjustments. Importantly, the new aged 65+ second additional deduction does not lower your adjusted gross income (AGI).

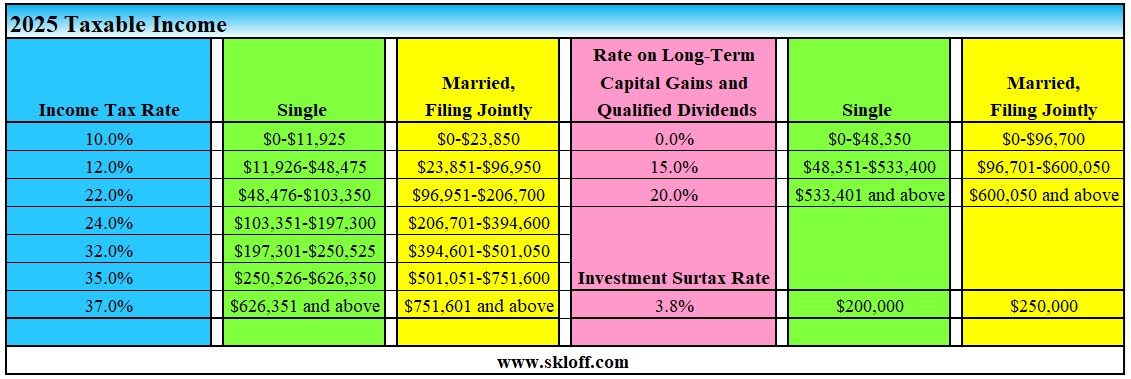

Strategy. When converting pre-tax retirement accounts, optimize your income tax brackets and pay close attention to the Medicare Income-Related Monthly Adjustment Amount (IRMAA) premiums (Medicare Part B premiums based on your income). IRMAA calculations are based on your MAGI from two years prior. See the tables below.

Click to Enlarge

Click to Enlarge

8. Open a Trump Account

The new law creates a savings account for children that allows parents and others to contribute up to a combined $5,000 per year until the child turns 18. Employers can contribute up to $2,500 per year. The government will make a $1,000 one-time deposit for each child born in the U.S. from 2025 to 2028. The funds are available when the child turns 18. Like after-tax contributions to Traditional IRAs, earnings on withdrawals from Trump Accounts are taxed as income and are subject to pre-aged 59 ½ penalties unless an exception applies, like using the money for higher education expenses or for using up to $10,000 for a first-time home purchase. Trump Accounts will become available in 2026, with annual contribution limits adjusted for inflation beginning in 2027.

Strategy. Don’t look a gift horse in the mouth. Invest the money wisely and use it for purchases that are exempt from penalties.

9. Be More Charitable

Prior to the new tax law, you had to itemize your charitable contributions to gain a deduction. The new law permanently establishes a $1,000 charitable deduction for single filers and $2,000 from those married filing jointly, without needing to itemize the deduction. The new law also adds a 0.5% of AGI floor on charitable deductions for those that itemize. That means the first 0.5% of charitable contributions, as a percentage of AGI, will not be deductible. For example, if your AGI is $100,000 and you itemize, you can only deduct donations exceeding $500.

Strategy. Be more charitable and gain a tax deduction in the process, even if you file your taxes with a standard deduction.

10. Avoid the Alternative Minimum Tax (AMT)

Prior to the new tax law, the income exemption amounts for single and joint filers were scheduled to collapse in 2026. The new law permanently establishes the 2025 exemptions of $88,100 for single filers and $137,000 for joint filers, with annual inflation adjustments. The 2025 AMT exemption phaseout ranges are $626,350 to $978,750 for single filers and $1,252,700 to $1,800,700 for those married filing jointly, with a phaseout rate of $0.25 per $1.00. The new law slashes the 2026 phaseout ranges to $500,000 to $ 676,200 for single filers and $1,000,000 to $1,274,000 for those married filing jointly, with a phaseout rate of $0.50 per $1.00. For 2026, there is a 35% cap, even for those in the 37% tax bracket.

Strategy. Review your incentive stock options (ISOs) to determine if exercising them in 2025 nets greater tax savings versus delaying to future years.

Action Steps

Work closely with your Registered Investment Adviser (RIA) to reduce your taxes and grow and preserve your wealth.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA) is CEO of Skloff Financial Group, a Registered Investment Advisory firm specializing in financial planning, investment management and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.