Understand the Impact of the Investment Surtax – Independent Press

The Independent Press

Understand the Impact of the Investment Surtax

Money Matters – Question of the Month – August 6, 2014

By Aaron Skloff, AIF, CFA, MBA

Q: What is the new investment surtax and how can we avoid some or all of it?

The Problem – New Investment Surtax Can Cost You 3.8%

Effective Jan. 1, 2013, you may pay an additional 3.8% surtax on your investment income. The Net Investment Income Tax (NIIT), or investment surtax, is imposed by section 1411 of the Internal Revenue Code. If you file your taxes as a single person and your adjusted gross income (AGI) is $200,000 or greater or if you file your taxes jointly and your AGI is $250,000 then you are the target of this new tax. As it applies to the new rules, investment income includes: dividends, rents, royalties, interest, short term and long term capital gains and taxable annuity payments. The surtax applies to the income above $200,000 or $250,000, respectively.

Although 3.8% may not seem like a large additional tax it is important to know what the current tax rate is on some of the most common sources of income being impacted. Specifically, the tax rate on most dividends and long term capital gains is 15.0%. The surtax translates to an over 25% (3.8% / 15.0%) increase in the actual taxes paid on the impacted income.

Although the following items may increase your AGI and increase the amount of surtax you may pay they are not subject to the surtax: wages, self-employment income; distributions from IRAs, Roth IRAs and company retirement plans, municipal bond interest, death benefit proceeds from life insurance policies, veterans’ benefits and Social Security income.

Are You Interested in Learning More?

The Solution — Reduce Your Adjusted Gross Income (AGI) and Increase Your Retirement Savings

One of the easiest ways to avoid the 3.8% surtax on investment income is to reduce your adjusted gross income (AGI) to $250,000 for joint filers ($200,000 for single filers). No, I am not suggesting you compromise your income simply to avoid taxes on your income. I am suggesting you take advantage of your employer sponsored retirement plan to reduce your AGI. A potentially greater benefit of reducing your AGI is the reduction in income taxes. Let’s look at three examples.

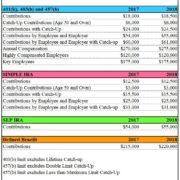

Example 1 — Single Person Age 50 Working at a Company. When you contribute $23,000 ($17,000 if under age 50) to your

When you contribute $23,000 ($17,500 if under age 50) to your 401(k) you reduce your AGI by $23,000. This contribution reduces your AGI from $223,000 to $200,000 and eliminates the surtax.

Example 2 — Husband and Wife Each Age 50 Working at Companies. When you each contribute $23,000 ($17,500 if under age 50) to your 401(k) you reduce your combined AGI by $46,000. These contributions reduce your AGI from $296,000 to $250,000 and eliminate the surtax.

Example 3 — Husband and Wife Each Age 50 Working at Public Schools. When you each contribute$23,000 ($17,500 if under age 50) to your 403(b) you reduce your combined AGI by $46,000. When you each simultaneously contribute $23,000 ($17,500 if under age 50) to your 457(b) you reduce your combined AGI by another $46,000. These contributions reduce your AGI from $342,000 to $250,000 and eliminate the surtax.

Although retirement account withdrawals are not subject to the surtax, they could be subject to income taxes. Fortunately, there are additional estate planning and financial planning strategies to avoid required minimum distributions (RMDs). As a result, these strategies avoid income taxes and the surtax.

Often Overlooked. Another way of reducing your AGI, avoiding the surtax and creating a tax free savings account to pay medical costs and long term care insurance premiums is to contribute to your employer sponsored Health Savings Account (HSA).

Action Steps – Avoid the New Investment Surtax

When you contribute to your employer sponsored retirement account you can accomplish two goals simultaneously — create a healthy retirement nest egg and avoid the surtax.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA) is CEO of Skloff Financial Group, a Registered Investment Advisory firm based in Berkeley Heights. He can be contacted at www.skloff.com or 908-464-3060.