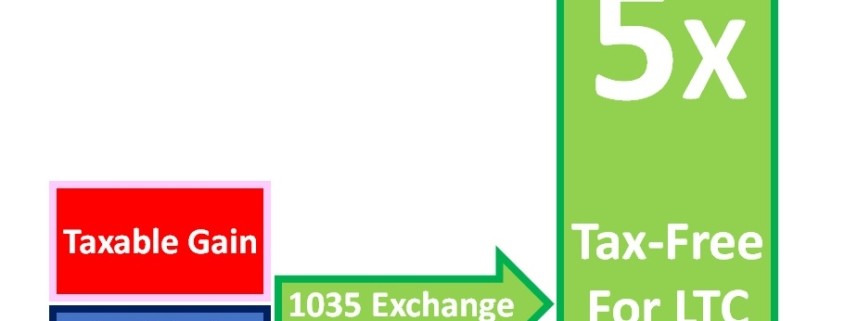

Convert an Old Annuity to a New Hybrid Annuity with Long Term Care and Get 5 Times the Value in Tax Free Long Term Care

Click to Enlarge

Convert an Old Annuity to a New Hybrid Annuity with Long Term Care and Get 5 Times the Value in Tax Free Long Term Care

73% of Annuity Owners Intend to Use Their Annuity for a Catastrophic Illness or Nursing Home Care

Many consumers purchase an annuity based on their existing and future needs. As those needs change, they realize their existing annuity is inadequate. With the 1035 exchange of an old traditional annuity to a new Hybrid Annuity and LTC, you can gain double, triple, quintuple or even unlimited the value of the original annuity for LTC costs. The Pension Protection Act (PPA) of 2006 added additional flexibility to the tax-free 1035 exchange of old annuities to new annuities. If the new annuity is a Hybrid Annuity with LTC policy and withdrawals are for LTC costs, all the gains from the original policy and the doubling, tripling, etc. of value are tax-free.