Understanding Single Premium Deferred Annuities

Money Matters – Skloff Financial Group Question of the Month – November 1, 2019

By Aaron Skloff, AIF, CFA, MBA

Q: We read the Understanding Annuities article and are interested in single premium deferred annuities (SPDAs). Can you please explain SPDAs?

The Problem – Guaranteed Lifetime Cash Flow Starting in the Future

There is a scarcity of guaranteed lifetime cash flow. According to U.S. News and World Report, only 17% of company employees were offered a traditional pension plan in 2018. Even your Social Security Statement reads, “Your estimated benefits are based on current law. Congress has made changes to the law in the past and can do so at any time.” Note, that sentence is printed in bold on statements.

The Solution – Single Premium Deferred Annuities (SPDAs)

Let’s start with defining single premium deferred annuities (SPDAs), also known as an income annuities or personal pensions. Here comes a brief history lesson. The Roman Empire paid soldiers annua (annual stipends) as compensation for military service. A SPDA pays a guaranteed cash flow in the future for a fixed period or over your lifetime, with “your” meaning you or you and your spouse.

The Size and Duration of Your Cash Flows Can Vary Based on the Cash Flow Option You Choose

While the natural inclination is to choose a higher cash flow over a lower cash flow, you could make an irreversible error. We examine the most common options below. Based on the same age, single lives pay more than two lives and men receive higher cash flows than women.

Life Only. This option pays the highest one life cash flow because payments stop when you die, even if you have only received one payment.

Life with 10 Years Certain. This option pays a lower cash flow because payments stop when you die, unless you die within 10 years of your cash flows. If you die within 10 years of your cash flows, your beneficiaries receive payments until the 10th year of payments are complete.

Life with Cash Refund. This option pays a lower cash flow because payments stop when you die, unless you die before all your cumulative payments equal the premium you paid. If your cumulative cashflows at death are lower than the premium you paid, your beneficiaries are refunded the difference.

Life Only for Two Lives. This option pays the highest two lives cash flow because payments stop when the second persons dies, even if they have only received one payment.

Life with 10 Years Certain for Two Lives. This option pays a lower cash flow (based on age) because payments stop when the second person dies, unless they die within 10 years of your cash flows. If they die within 10 years of your cash flows, your beneficiaries will continue to receive payments until the 10th year of payments are complete.

Life with Cash Refund for Two Lives. This option pays a similar cash flow (based on age) because payments stop when the second person dies, unless they die before all your cumulative payments equal the premium you paid. If your cumulative cashflows at death are lower than the premium you paid, your beneficiaries are refunded the difference.

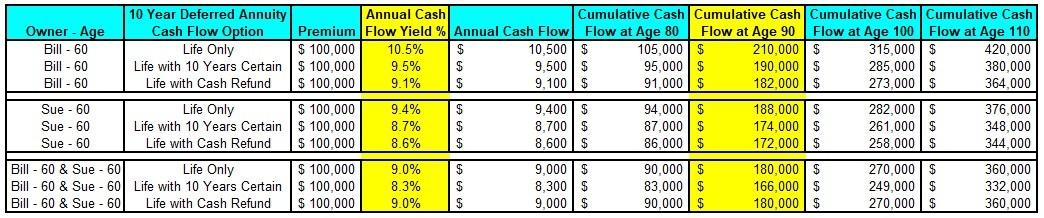

Numbers Speak Louder Than Words. Let’s look at three examples of 10 year deferred SPDAs. In the first example, Bill (60) can pay $100,000 for a SPDA with: life only paying 10.5% or $10,500 annually, life with 10 years certain paying 9.5% or $9,500, or life with cash refund paying 9.1% or $9,100. If he chooses a life only and lives to 90, he will receive $210,000 in cumulative cash flows. In the second example, Sue (60) can pay $100,000 for a SPDA with: life only paying 9.4% or $9,400 annually, life with 10 years certain paying 8.7% or $8,700, or life with cash refund paying 8.6% or $8,600. If she chooses a life only and lives to 90, she will receive $188,000 in cumulative cash flows. In the third example, Bill (60) and Sue (60) can pay a combined $100,000 for a SPDA with: life only paying 9.0% or $9,000 annually, life with 10 years certain paying 8.3% or $8,300, or life with cash refund paying 9.0% or $9,000. If they choose a life only and either lives to 90, they will receive $180,000 in cumulative cash flows. The higher your age, the higher the percentage of your cash flow that is a tax-free return of principal (exclusion ratio). See chart below.

Click to Enlarge

Action Steps – Evaluate Your Cash Flow Options and Choose the One or Combination of More Than One That Meets Your Needs

Before purchasing a SPDA evaluate your cash flow options and choose the best option or combination of more than one option that meets your needs. Work closely with an experienced financial professional to understand all the capabilities and limitations of SPDAs.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA) is CEO of Skloff Financial Group, a Registered Investment Advisory firm specializing in financial planning, investment management and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.