Stretch IRA 2016

Click to Enlarge

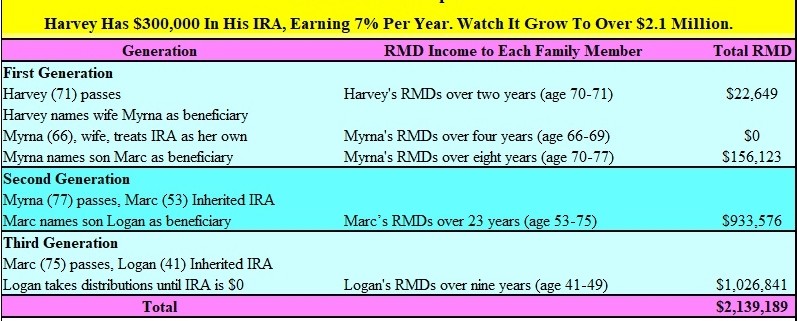

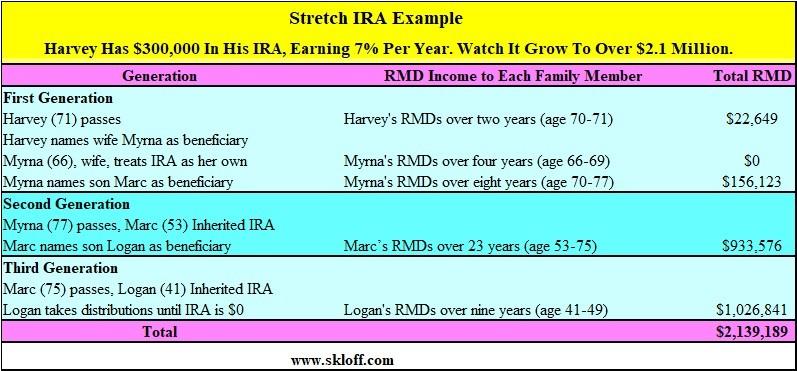

Stretch IRA Example

Harvey Has $300,000 In His IRA, Earning 7% Per Year. Watch It Grow To Over $2.1 Million.

Naming your family as the designated beneficiaries on your IRA allows your family to inherit your IRA and simultaneously take advantage of a Stretch IRA. A Stretch IRA is not a different type of IRA, but simply a strategy of “stretching” the tax sheltering benefits of an IRA beyond your own life. Taking only the RMDs leaves your family the largest amount possible from your IRA.