Are Dividends as Good as They Sound? – Part 2

Money Matters – Skloff Financial Group Question of the Month – June 1, 2021

By Aaron Skloff, AIF, CFA, MBA

Q: We read the article ‘Are Dividends as Good as They Sound?’ Part 1. If companies are not required to pay stockholders dividends, then why do they pay them?

The Problem – Investing in Companies That Create Good Products and Services, But Do Not Optimize Their (Really, Your) Capital

Many investors believe the executives that work for them are good at their jobs. While many are good at creating products and services, they are not good at optimizing their (really, your) capital – and that is a problem.

Are You Interested in Learning More?

The Solution – Investing in Companies That Create Good Products and Services, And Optimize Their (Really, Your) Capital

Companies have many options when determining how to optimize the profits they earn for you and the capital they manage for you. Some of those options include:

- Develop New Products and Services. This can be risky for weak management teams and very lucrative for strong management teams.

- Increase Existing Products and Services. This may appear less risky than developing new products and services, but competitors are always developing new products and services. Strong management will balance allocating capital between existing and new businesses.

- Acquire or Invest in Other Businesses. While acquiring or investing in a company can be an enticing way to grow a business, growth by acquisition is often a losing proposition. According to the Harvard Business Review, 70% to 90% of mergers and acquisitions fail. Management teams that have successfully acquired and integrated several acquisitions are more likely to repeat their success. Financial discipline is key.

- Issue, Maintain, Reduce, Refinance or Eliminate Debt. Debt can be a company’s friend for expansion or its enemy if interest and principal payments constrict the company. Strong management will optimize the new issuance, maintenance, reduction, refinancing and elimination of debt. Careless management can bankrupt a company.

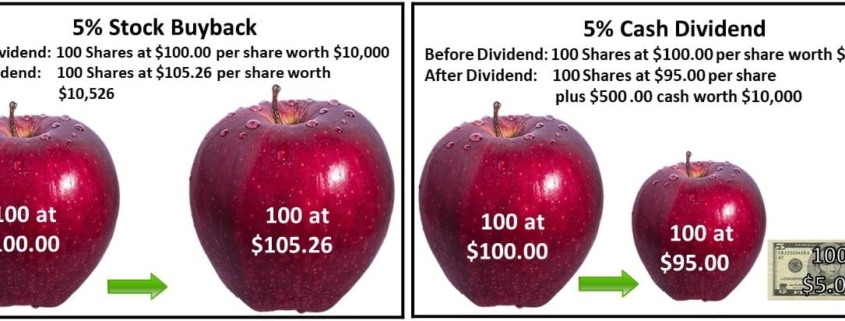

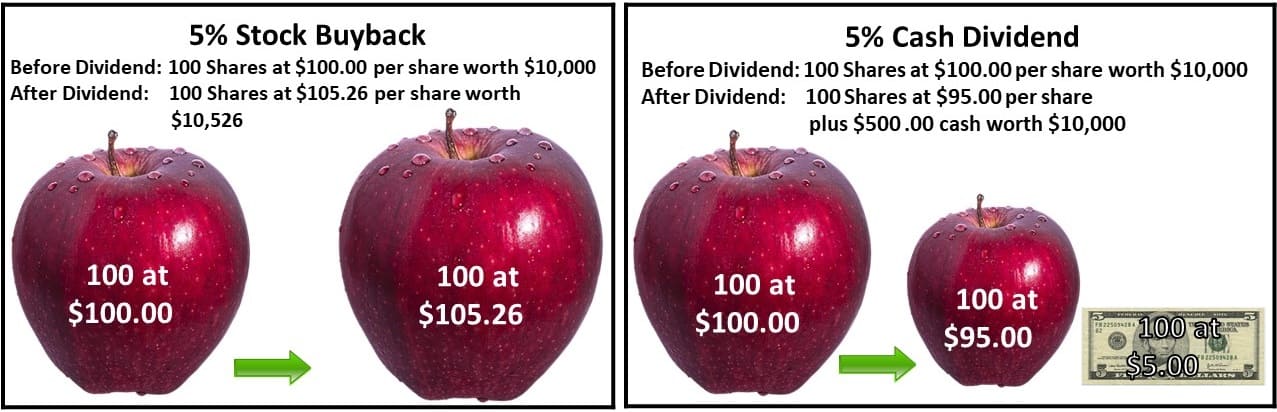

- Buy Back Stock. When a company buys back its own stock it reduces the number of shares outstanding. As earnings (profits) are spread over a smaller number of shares the earnings per share (EPS) increase and the value per share increases. For example, a 5% share buyback for a company valued at $10 million with 100,000 shares would reduce the number of shares to 95,000 and increase the $100 per share price to $105.26. Stock buybacks are tax-free. See the infographic below for examples of a stock buyback and cash dividend.

- Cash Dividends. Imagine this: The Board of Directors of your company is evaluating paying a cash dividend. The Chairman of the Board, MBA from Harvard, asks the Board members if the company should pay a cash dividend. The head of product development, PhD from Stanford, says she does not have any new products and services worthy of investment. The head of mergers and acquisitions, MBA from NYU, says he cannot find any companies worth acquiring. The CFO, MBA from Columbia, says she likes paying interest on the company’s debt and would prefer a cash dividend on her own shares instead of buying back stock. Guess what this ‘talented’ management team agrees to do with your capital? They pay a cash dividend. They issue a press release describing how proud they are that they increased the cash dividend from the previous year. They must assume the stockholders know how to invest capital better than they do. If the Board and management cannot develop better ideas than paying a cash dividend, the stockholders should replace them.

Click to Enlarge

Action Steps – Understand the Pros and Cons of Dividends Before Buying or Selling a Stock

Some investors view dividends as ‘found money’, while others view dividends as a ‘waste of capital’. Before buying or selling a stock understand the pros and cons of dividends. Work closely a Registered Investment Adviser (RIA) to make the best investment decisions.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA) is CEO of Skloff Financial Group, a Registered Investment Advisory firm specializing in financial planning, investment management and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.