Top 10 Tax Tips Created by the New Tax Law – Part 2 – 10/01/25

Money Matters – Skloff Financial Group Question of the Month – October 1, 2025

By Aaron Skloff, AIF, CFA, MBA

Q: We read ‘Top 10 Tax Tips Created by the New Tax Law’ Part 1. With the One Big Beautiful Bill (OBBB) signed into law, what are the top 10 tips created by the new law?

The Problem – Extracting Valuable Benefits from the New Tax Law

Extracting valuable tax planning benefits from 870 pages of a new tax law can seem like an insurmountable task.

The Solution – The Top 10 Tax Tips Created by the New Tax Law

Below are the top 10 financial and tax planning tips that can provide you with financial benefits and tax savings for years to come.

Are You Interested in Learning More?

4. Optimize Income to Gain New Aged 65+ Additional Standard Deduction

Prior to the new law, taxpayers 65 and older were provided with an aged 65+ deduction in addition to the standard deduction. The new law retains the first aged 65+ first additional deduction and creates an aged 65+ second additional deduction of $6,000 whether you use the standard deduction or itemize. The new second additional deduction begins phasing out as your MAGI exceeds $75,000 for single filers and $150,000 for those married filing jointly, and is phased out at $175,000 and $250,000, respectively. The new aged 65+ second additional deduction applies to 2025-2028.

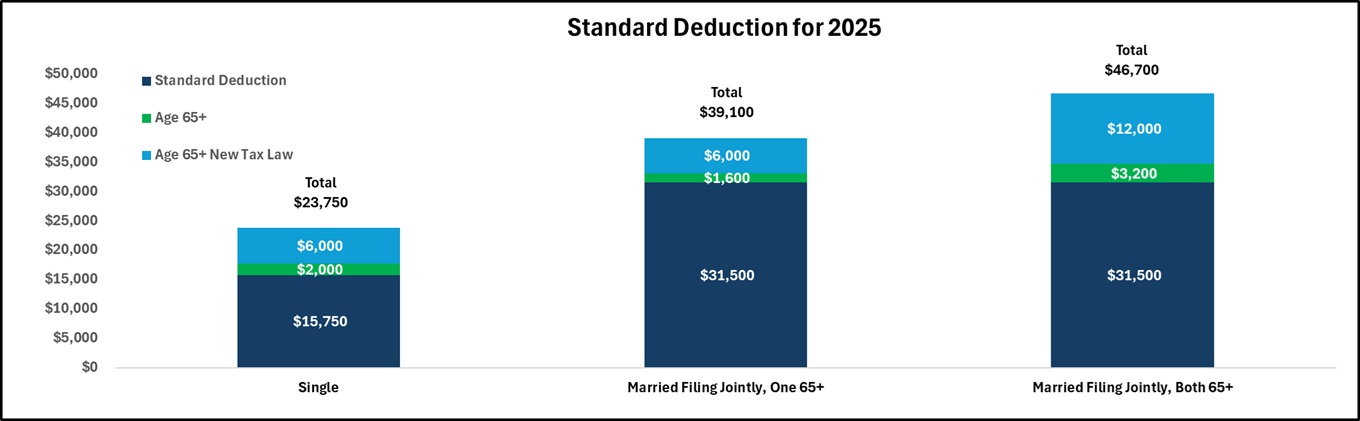

The 2025 standard deductions are as follows: Standard Deduction plus Aged 65+ First Additional Deduction plus Age 65+ Second Additional Deduction equal Total Standard Deduction: Single $15,750 + $2,000 + $6,000 = $23,750; Married Filing Jointly One 65+ $31,500 + $1,600 + $6,000 = $39,100; Married Filing Jointly Both 65+ $31,500 + $3,200 + $12,000 = $46,700. See the chart below.

Strategy. Instead of earning all your income in one year and losing some or all of your deduction, spread out your income to gain more or all of your deduction.

Click to Enlarge

5. Earn More Tip Income

Prior to the new law, tip income did not have its own deduction. The new law creates a deduction for qualified tip income of up to $25,000 for those filing their taxes as single or married filing jointly. Tip income is voluntary income from a job where tips are customarily given. While it is customary to tip a waiter or waitress, it is uncustomary to tip your doctor. The deduction begins phasing out as your MAGI exceeds $150,000 for single filers and $300,000 for those married filing jointly. Each $1,000 above $150,000 or $300,000, respectively, reduces your deduction by $100. The new tip deduction applies to 2025-2028.

Strategy. Instead of earning all of your tip income in one year and losing some or all of your deduction, spread out your tip income over two years to gain more or all of your deduction.

6. Review Your Estate Plan

Prior to the new tax law, the lifetime gift (in addition to annual gifts) and estate tax exemption was scheduled to collapse by about 50% in 2026. The new law permanently establishes a lifetime gift (in addition to annual gifts) and estate tax exemption of $15 million for individuals and $30 million for couples (based on portability election) for 2026, with annual inflation adjustments thereafter.

Strategy. Estate planning includes a host of factors and strategies that go well beyond the estate tax exemption. Review your gifting strategy of appreciated and unappreciated assets. Thoroughly understand how nonqualified and qualified assets, including 401(k)s and IRAs, are taxed differently for you versus your surviving spouse versus your children and other beneficiaries. Your suboptimal estate planning can be a windfall to the IRS and a nightmare to your beneficiaries.

Action Steps – Reduce Your Taxes and Improve Your Financial Position

Work closely with your Registered Investment Adviser (RIA) to reduce your taxes and grow and preserve your wealth.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA) is CEO of Skloff Financial Group, a Registered Investment Advisory firm specializing in financial planning, investment management and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.

Are You Interested in Learning More?