Are Social Security Benefits Taxed? – Part 2

Money Matters – Skloff Financial Group Question of the Month – November 1, 2022

By Aaron Skloff, AIF, CFA, MBA

Q: I read the articles ‘What Is the Best Age to Claim Social Security Benefits?’ Part 1, Part 2 and ‘What Is the Best Age to Claim Spousal Social Security Benefits?’ and ‘What Is the Best Age to Claim Survivor Social Security Benefits?’ Part 1, Part 2, ‘How the Government Pension Offset (GPO) Affects Social Security Benefits‘, ‘How the Windfall Elimination Provision (WEP) Affects Social Security Benefits‘ and ‘Are Social Security Benefits Taxed?’ Part 1. Can you provide examples of when and how Social Security benefits would be taxed under various scenarios?

The Problem – Tax, Taxes and More Taxes

Understanding when and how Social Security benefits (“benefits”) are taxed is tricky. Without examples, it is difficult to visualize.

The Solution – No Taxes, No Taxes, Unless…

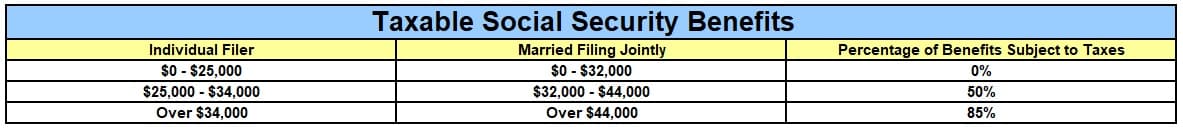

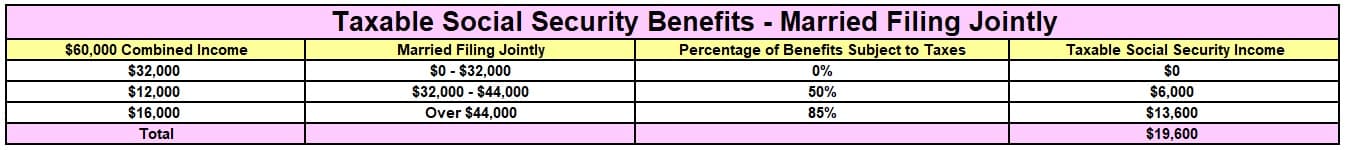

Combined Income. The dollar amount of benefits that are taxable is based on your combined income. Your combined income is the aggregate of your adjusted gross income (AGI) plus your nontaxable interest plus 50% of your benefits. For single filers: the first $25,000 of combined income is nontaxable, from $25,000 to $34,000 50% is taxable and over $34,000 85% is taxable. For those married filing jointly: the first $32,000 of combined income is nontaxable, from $32,000 to $44,000 50% is taxable and over $44,000 85% is taxable. See the table and common scenarios below.

Click to Enlarge

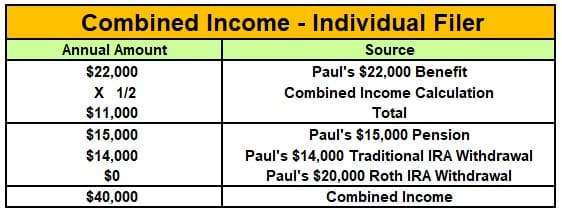

Combined Income – Individual Filer Example. Paul receives benefits, a pension and retirement account withdrawals. To determine his combined income, he adds 50% of his $22,00 benefit plus all of his $15,000 pension income plus all of his $14,000 Traditional IRA withdrawals to calculate his combined income. Note: he can exclude all of his Roth IRA withdrawals from his calculation. See below.

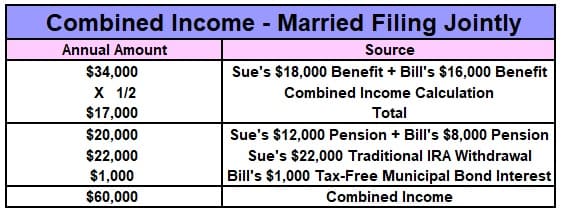

Combined Income – Married Filing Jointly Example. Sue and Bill receive benefits, a pension, retirement account withdrawals and nontaxable interest. To determine their combined income, they add 50% of their $34,000 benefits plus all of their $20,000 pension income plus all of their $22,000 Traditional IRA withdrawals plus all of their $1,000 nontaxable interest. See below.

Click to Enlarge

Click to Enlarge

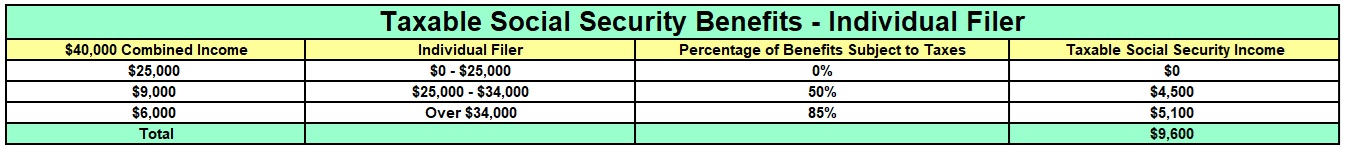

Taxable Social Security Benefits – Individual Filer Example. Applying the Taxable Social Security benefits table above to Paul’s $40,000 combined income result in $9,600 of Paul’s $22,000 of benefits being taxable. See the table below.

Click to Enlarge

Taxable Social Security Benefits – Married Filing Jointly Example. Applying the Taxable Social Security benefits table above to Sue and Bill’s $60,000 combined income result in $19,600 of their $34,000 of benefits being taxable. See the table below.

Click to Enlarge

Action Steps – Closely Examine Your Sources of Income, Since Some Tax Free Sources Can Be Included in Combined Income

Work closely with your Registered Investment Adviser (RIA) to optimize your taxes on Social Security benefits.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA) is CEO of Skloff Financial Group, a Registered Investment Advisory firm. He can be contacted at www.skloff.com or 908-464-3060.