How To (Legally) Avoid Taxes When Selling Your Home – Part 3

Money Matters – Skloff Financial Group Question of the Month – June 1, 2024

By Aaron Skloff, AIF, CFA, MBA

Q: We read ‘How To (Legally) Avoid Taxes When Selling Your Home’ Part 1 and Part 2. We are ready to sell our home and are worried about paying taxes on our gain. Can you give examples of the tax implications of selling a home?

The Problem – Paying Unnecessary Taxes When Selling Your Home

Selling your home can be an exciting and sometimes stressful time. It is easy to lose track of tax records, copies of contracts and copies of home improvement receipts Thus, many people miscalculate the gain on the sale of their home. Simply subtracting your purchase price from your sales to determine your gain is a common and costly mistake.

Are You Interested in Learning More?

The Solution – A Side-by-Side Comparison of Taxes – How to (Legally) Avoid Taxes When Selling Your Home

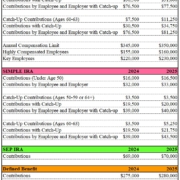

By examining a side-by-side comparison in the table below, you can see how you can pay high, low or no taxes when selling your home. In the comparison below you purchased your home for $50,000, spent $20,000 on a bathroom renovation, spent $30,000 on a kitchen renovation, and sold your home for $600,000. By keeping good tax records, copies of contracts and copies of receipts you were able to add the price of your $20,000 bathroom renovation and $30,000 kitchen renovation to your $50,000 price purchase price, resulting in a $100,000 Adjusted Basis.

Based on your length of ownership, you paid varying tuxes and yielded varying proceeds net of taxes. You are married filing jointly and are in the 35% marginal income tax bracket. Based on your income, your capital gains are subject to the Net Investment Income Tax (NIIT or investment surtax).

Paying High Taxes When Selling Your Home. Based on selling your home in 1 year or less (short term capital gain) from the time you purchased it, you are subject to income taxes of $175,000 ($500,000 gain X 35%) plus NIIT of $19,000 ($500,000 gain X 3.8%). Your total taxes are $194,000, leaving you with $406,000 of proceeds net of taxes. See the red (danger zone) section of the table below.

Paying Low Taxes When Selling Your Home. Based on selling your home in more than 1 year but less than 2 years (long term capital gain) from the time you purchased it, you are subject to long term capital gains taxes of $100,000 ($500,000 gain X 20%) plus NIIT of $19,000 ($500,000 gain X 3.8%). Your total taxes are $119,000, leaving you with $481,000 of proceeds net of taxes. See the yellow (safe zone) section of the table below.

Paying No Taxes When Selling Your Home. Based on selling your home in 2 years or more from the time you purchased it and meeting the Eligibility Test, you are exempt from capital gains and NIIT taxes on the sale of your home. Since your total taxes are $0, you are left with $600,000 of proceeds. See the green (ultra safe zone) section of the table below.

Click to Enlarge

Action Steps

Keep good tax records, copies of contracts and copies of receipts. Work closely with your Registered Investment Adviser (RIA) to reduce your taxes, and grow and preserve your wealth.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA) is CEO of Skloff Financial Group, a Registered Investment Advisory firm specializing in financial planning, investment management and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.