Indiana Long Term Care Partnership Program – Long Term Care University – 10/15/14

Long Term Care University – Question of the Month – 10/15/14

Research

By Aaron Skloff, AIF, CFA, MBA

Q: Some insurance companies offer Partnership Qualified long term care insurance policies. Can you explain what that means, what advantages it may provide and if the Indiana Long Term Care Partnership Program is unique?

The Problem – Limited Benefits and Limited Medicaid

Most long term care (LTC) insurance policies provide a limited amount of benefits. Even lifetime benefit policies generally have a daily, monthly or annual limit. The cost of long term care after a policy has been exhausted can be financially devastating for you and your family. To compound the problem, assistance in the form of Medicaid is generally limited to the impoverished. Furthermore, Medicaid can disqualify you for benefits if you gifted or transferred assets five years before applying for benefits. The five year “look-back” period was increased from three years with the Deficit Reduction Act (DRA) of 2005 and is likely to increase again.

The Solution – Partnership Qualified Long Term Care Insurance Policies

The Partnership Program is based on the Robert Wood Johnson Foundation program called the Program to Promote Long Term Care Insurance for the Elderly, initiated in 1987. Today, a Partnership Program is a “partnership” between a state, an insurance company and state residents who buy long term care Partnership policies. With a Partnership Qualified policy you can apply for Medicaid with ‘asset disregard’. This allows you to keep assets that would otherwise be disallowed. In almost all states that have Partnership Programs, the amount of assets Medicaid will disregard is equal to the amount of the benefits you actually receive under your LTC Partnership Qualified policy. This type of asset disregard is often referred to as Dollar for Dollar.

Let’s say you are a New Jersey (NJ) resident who purchases $355,875 (the median rate of a private nursing room for an average three year stay in NJ) worth of insurance through a Partnership Qualified policy. When the care is needed, the policy actually pays for $975,000 of care (due to inflation protection). Thus, $975,000 of your assets would be protected away from NJ Medicaid.

The Indiana Long Term Care Partnership Program

Only two states in the entire U.S. can offer both Dollar for Dollar and Total Asset Partnership Programs – Indiana and New York. As its name implies, Total Asset offers unlimited asset protection from Medicaid – far more powerful than Dollar for Dollar.

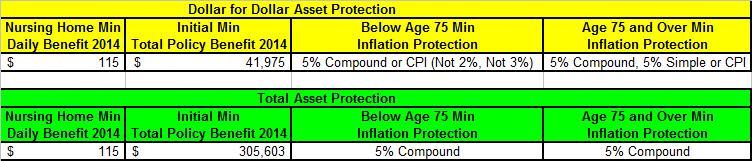

Let’s say you are an Indiana resident who purchases an Indiana Long Term Care Partnership Program Qualified policy. After you exhaust your policy, you can apply for Indiana Medicaid – which allows you to protect some or all of your assets, depending on whether you select a Dollar for Dollar Asset Protection plan or a Total Asset Protection plan. However, your income is considered in determining your eligibility for Indiana Medicaid Coverage. A minimum daily nursing home benefit required by the State is set each January (based on 75% of the average daily nursing home daily benefit in Indiana). The plans are as follows:

Click to Enlarge

Often Overlooked – Tax Deductions for Indiana Long Term Care Partnership Policies

Indiana residents who pay premiums for qualified (as defined in IC 12-15-39.6-5) Indiana Partnership long term care insurance policies for themselves, their spouse, or both can receive a state tax deduction (reducing the amount of your taxable income), beginning in 2000.

Action Step – Purchase a Long Term Care Partnership Policy

When you purchase a Partnership Qualified policy, you gain the safety of long term care insurance and the peace of mind provided by asset protection – Total Asset protection in the case of Indiana and New York.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA) charter holder, Master of Business Administration (MBA), is the Chief Executive Officer of Skloff Financial Group, a Registered Investment Advisory firm. The firm specializes in financial planning and investment management services for high net worth individuals and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.