What Is the Best Age to Claim Spousal Social Security Benefits?

Money Matters – Skloff Financial Group Question of the Month – October 1, 2022

By Aaron Skloff, AIF, CFA, MBA

Q: I read the articles ‘What Is the Best Age to Claim Social Security Benefits?’ Part 1 and Part 2. What is the best age to claim Spousal Social Security benefits?

The Problem – Determining When to Claim Spousal Social Security Benefits Versus Your Own Benefits

If you have a spouse, you can claim your own benefits or spousal benefits. The problem is your benefits are based on your spouse’s earnings history and the age you claim your spousal benefit.

The Solution – The Best Age to Claim Spousal Social Security Benefits

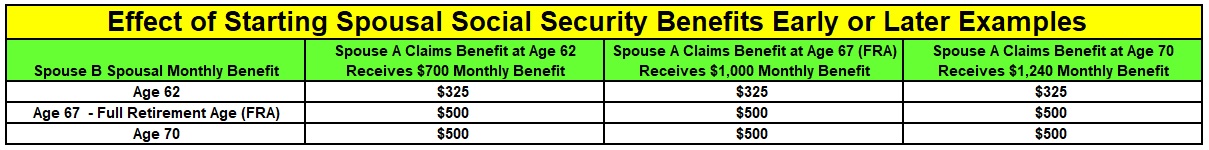

Spousal benefits are capped at 50% of your spouse’s benefit. If your own benefit is greater than 50% of your spouse’s benefit, you should take your own benefit. If your own benefit is less than 50% of your spouse’s benefit, you should take your spousal benefit. Once your spouse (who you have been married to for at least one year) files for benefits, you can claim your spousal benefit. As examined in Part 1, there are three primary factors you should consider in determining your best age to claim benefits. Spousal benefits are based on the full retirement age (FRA) of the higher earning spouse. Based on your birth year, your FRA is the age at which the Social Security Administration (SSA) pays 100% of your benefit. The following table shows the effect of starting spousal benefits early or later.

Click to Enlarge

Let’s look at claiming spousal benefits at ages 62, 67 and 70.

Spousal Benefit at Age 62. If your spouse (Spouse A) and you (Spouse B) were born in 1960 and your spouse’s benefit at age 62 is $700 per month, you would receive 32.5% of your spouse’s full retirement age (FRA) benefit or $325 per month. You and your spouse are penalized for taking benefits ‘early’ – before your FRA. Please see the table in Part 1 for your own benefits at ages 62-70 and the table above for spousal benefits at ages 62-67.

Spousal Benefit at Age 67. If your spouse (Spouse A) and you (Spouse B) were born in 1960 and your spouse’s benefit at age 67 (Spouse A’s FRA) would be $1,000 per month, you would receive 50.0% of your spouse’s full retirement age (FRA) or $500 per month. Neither of you are penalized for taking benefits at your full retirement age (FRA).

Spousal Benefit at Age 70. If your spouse (Spouse A) and you (Spouse B) were born in 1960 and your spouse’s benefit at age 70 would be $1,240 per month, you would receive 50.0% of your spouse’s full retirement age (FRA) or $500 per month. Importantly: while Spouse A’s benefits increase when benefits are delayed to age 70, spousal benefits for Spouse B do not increase when benefits are delayed past age 67.

Click to Enlarge

Widow or Widower Benefits. A widow or widower whose spouse waited until 70 to file for Social Security is entitled to the full amount the deceased spouse was receiving if the surviving spouse has reached full retirement age (FRA).

Action Steps – Determine the Best Age to Claim Social Security Benefits Based on Your Wants and Needs

Work closely with your Registered Investment Adviser (RIA) to determine the best age to claim spousal Social Security benefits.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA) is CEO of Skloff Financial Group, a Registered Investment Advisory firm. He can be contacted at www.skloff.com or 908-464-3060.