Combination Life and Long Term Care Insurance with Lifetime Benefits and Inflation Protection – Long Term Care University – 05/15/15

Long Term Care University – Question of the Month – 05/15/15

Research

By Aaron Skloff, AIF, CFA, MBA

Q: We read the 1st, 2nd , 3rd, 4th , 5th, 6th 7th, 8th and 9th Long Term Care University articles on Combination Life and Long Term Care (LTC) insurance policies and decided to purchase a Combination policy. Instead of a limited number of years of coverage, are lifetime benefits available on Combination (Combo or Hybrid or Linked Benefits or Asset Based) Life and Long Term Care (LTC) insurance policies? Can the policy have inflation protection?

The Problem – The Cost of an Extended Period of Long Term Care and Increasing Costs for Long Term Care Services

According to the U.S. Department of Health and Human Services, 7 in 10 people over the age 65 will require long term care. Although the average length of long term care is approximately three years, 20% will need care for longer than five years. The cost of long term care is staggering: $91,000 per year for a nursing facility, $43,000 per year for the base rate in an assisted living facility and $42,000 per year for 40 hours per week of home care. Applying the historical 4% compound growth rate of long term care services, the cost of care will double every 18 years.

One of the largest long term care insurance companies reported that 50% of all claims dollars it has paid are due to dementia, including Alzheimer’s disease. According to the Alzheimer’s Association, 1 in 9 people age 65 and older and about 1 in 3 people age 85 and older have Alzheimer’s disease. The duration of Alzheimer’s disease is generally four to eight years after a diagnosis, but can last as long as 20 years. Unfortunately, the cost of an extended period of long term care can destroy a lifetime of savings.

The Solution – Combination Life and Long Term Care Insurance with Lifetime Benefits and Inflation Protection

Lifetime Benefits (or Unlimited Benefits) are extinct at almost every Traditional Long Term Care Insurance company. Fortunately, lifetime benefits (unlimited number of months or years) exist on Combination policies. Combination policies with inflation protection further assure the benefits retain their purchasing power in the face of increasing costs for long term care services.

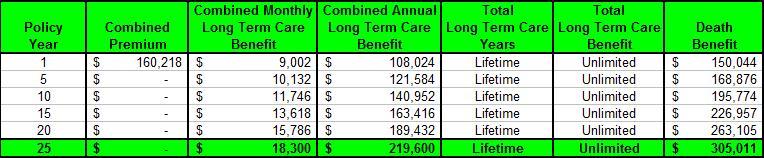

Numbers Speak Louder than Words. Let’s look at a husband and wife that are each 55 years of age. If they make a combined one-time premium payment of $160,218 they immediately gain a combined tax free $9,002 per month ($4,501 per month per person) long term care benefit. This equates to a combined $108,024 per year ($54,012 per year per person) benefit available for an unlimited number of months for LTC costs; literally a lifetime of long term care. They also gain an immediate $150,044 tax free death benefit when the second person dies, assuming the policy’s LTC benefits are unused. With inflation protection, their benefits will grow at a fixed 3% compound growth rate. In 25 years when they are likely to need LTC at the age of 80, they will have a tax free $18,300 per month ($9,150 per month per person) long term care benefit. This equates to a combined $219,600 per year ($109,800 per year per person) benefit available for an unlimited number of months for LTC costs; literally a lifetime of long term care. If they each only need three years of care in 25 years from now at the age of 80, their policy would provide a combined $658,800 of long term care benefits. That gives them over four times leverage on the premiums they paid. At the same point in time, if they do not use the LTC benefits the policy will pay a tax free $305,011 death benefit when the second person dies.

Click to Enlarge

Action Step – Purchase a Combination Life and Long Term Care Insurance with Lifetime Benefits and Inflation Protection

Since the length of care you will need is unknown, the ideal policy is one that provides a lifetime of long term care benefits. In the event you never need long term care benefits a Combination policy will pay a life insurance benefit. Either way, you win.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA) charter holder, Master of Business Administration (MBA), is the Chief Executive Officer of Skloff Financial Group, a Registered Investment Advisory firm. The firm specializes in financial planning and investment management services for high net worth individuals and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.