How Social Security Benefits Affect Medicare Premiums

Money Matters – Skloff Financial Group Question of the Month – November 1, 2022

By Aaron Skloff, AIF, CFA, MBA

Q: I read the articles ‘What Is the Best Age to Claim Social Security Benefits?’ Part 1 , Part 2 , ‘What Is the Best Age to Claim Spousal Social Security Benefits?’ ,’What Is the Best Age to Claim Survivor Social Security Benefits?’ Part 1 and Part 2, ‘How the Government Pension Offset (GPO) Affects Social Security Benefits‘, ‘How the Windfall Elimination Provision (WEP) Affects Social Security Benefits‘, ‘Are Social Security Benefits Taxed?’ Part 1 and Part 2. Can my Social Security benefits affect my Medicare Part B premiums?

The Problem – Paying More for Your Medicare Part B Premiums, Yet Getting the Same Benefits as Everyone Else

Even though Medicare Part B benefits are the same for everyone (i.e.: medically necessary services, preventive services and durable medical equipment), your premiums are based on your income. The higher your income, the higher your premiums.

The Solution – Premiums Based on Your Income and Capping Premium Increases with the Hold Harmless Rule, But…

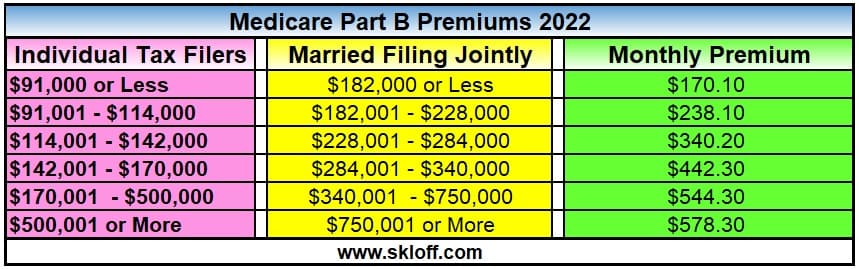

Per the article ‘Are Social Security Benefits Taxed?’ – Part 2: if you do not have substantial income, none of your Social Security benefits are taxable. If you have substantial income, some of your Social Security benefits are taxable. Instead of everyone paying the same Medicare Part B premium for the same coverage, some pay a higher premium for the same coverage. This additional amount you pay is based on a penalty called the income-related monthly adjustment amount (IRMAA). The IRMAA calculation is based on your modified adjusted gross income (MAGI) from two years ago. For individual tax filers with MAGI of $91,000 and married couples filing jointly with MAGI of $182,000 or less, the 2022 monthly Medicare Part B premium is $170.10. Those with higher MAGIs pay higher premiums. See the chart below.

Click to Enlarge

Hold Harmless Rule. Since 1975, Social Security’s general benefit increases have been based on increases in the cost of living, as measured by the Consumer Price Index (CPI). The increases are called Cost-Of-Living Adjustments, or COLAs. Many Medicare Part B participants are concerned that their Medicare Part B premiums will increase faster than their COLAs (as they have in the past). The Variable Supplementary Medical Insurance (VSMI) is the premium paid by those held harmless. A special rule for Social Security recipients, called the “hold harmless rule”, ensures that Social Security income amount will not decline from one year to the next because of increases in Medicare Part B premiums. But…

You are not protected by the Hold Harmless Rule if you: 1. Are on Medicare, but not Social Security, 2. Are subject to IRMAA, 3. Your Medicare premiums are not deducted from your Social Security benefits and 4. Are new to Medicare.

Strategies. Have your Medicare premiums deducted from your Social Security benefits. Do not commence Social Security and Medicare at age 65 simply to gain Hold Harmless Rule protection. Per the articles ‘What Is the Best Age to Claim Social Security Benefits?’ Part 1 and Part 2, commence benefits to maximize benefits to meet your needs. The cumulative additional Social Security benefits can easily outweigh the cumulative additional Medicare premiums. One of the biggest contributors to income in retirement are withdrawals from 401(k)s, 403(b)s and IRAs, which can cause IRMAA penalties. Mitigate or eliminate IRMAA penalties by avoiding bloated required minimum distributions (RMDs) and big withdrawals by using the Protected IRA Plus Pan (PIPP).

Action Steps – Manage Your Income, Since the Hold Harmless Rule Will Not Protect You from IRMAA Penalties

Work closely with your Registered Investment Adviser (RIA) to eliminate or mitigate IRMAA penalties.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA) is CEO of Skloff Financial Group, a Registered Investment Advisory firm. He can be contacted at www.skloff.com or 908-464-3060.