What Happens If You Collect Social Security Benefits While Working

Money Matters – Skloff Financial Group Question of the Month – November 1, 2022

By Aaron Skloff, AIF, CFA, MBA

Q: I read the articles ‘What Is the Best Age to Claim Social Security Benefits?’ Part 1 , Part 2 , ‘What Is the Best Age to Claim Spousal Social Security Benefits?’ ,’What Is the Best Age to Claim Survivor Social Security Benefits?’ Part 1 and Part 2, ‘How the Government Pension Offset (GPO) Affects Social Security Benefits‘, ‘How the Windfall Elimination Provision (WEP) Affects Social Security Benefits‘, ‘Are Social Security Benefits Taxed?’ Part 1, Part 2 and ‘How Social Security Benefits Affect Medicare Premiums‘. What happens if I collect Social Security benefits while working?

The Problem – Losing Social Security Benefits While Working

You have worked enough years and reached the age where you can collect Social Security benefits. Despite paying into the system for decades, your benefits are too meager to sustain your retirement – so, you plan to continue working. Here comes the gotcha. If you collect benefits while you are working, your benefits can be slashed.

The Solution – Understanding How You Social Security Benefits Can Be Slashed and How to Avoid It

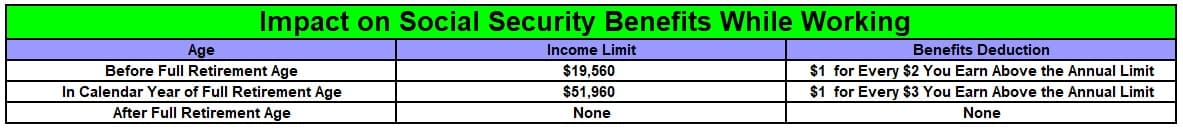

If you collect Social Security benefits before your full retirement age (FRA) and earn over $19,560: for every $2 of additional income you earn, the Social Security Administration (SSA) will deduct $1 from your benefits. If you collect benefits in the calendar year you reach your FRA and earn over $51,960: for every $3 of additional income you earn, the SSA will deduct $1 from your benefits. If you collect benefits after your FRA, there is no income limit and no deduction of benefits. See the chart below.

Click to Enlarge

Before Full Retirement Age Example. If your benefit is $22,00 per year and your income is $39,560, then $20,000 of your income would be subject penalty ($39,560 income – $19,50 limit = $20,000). For every $2 of income earned over the $19,560 income limit, $1 of benefits is deducted, resulting in a $10,000 deduction ($20,000 income subject to penalty / $2 = $10,000). Thus, you net benefit would be $12,000. See the chart below.

In Calendar Year of Full Retirement Age Example. If your benefit is $24,00 per year and your income is $71,960, then $20,000 of your income would be subject penalty ($71,960 income – $51,960 limit = $20,000). For every $3 of income earned over the $51,960 income limit, $1 of benefits is deducted, resulting in a $6,667 deduction ($20,000 income subject to penalty / $3 = $6,667). Thus, you net benefit would be $17,333. See the chart below.

After Full Retirement Age Example. Since there is not a benefit penalty if you earn income after your FRA, you can avoid any deduction. See the chart below.

Click to Enlarge

Income Included in Calculations. If you work for someone else, only your wages count toward Social Security’s earnings limits. If you are self-employed, only your net earnings from self-employment are counted. The SSA does not count income such as other government benefits, retirement account distributions, investment earnings, interest, pensions, annuities, and capital gains. The SSA counts your contributions to a pension or retirement plan, however, if the contribution amount is included in your gross wages.

Often Overlooked. If your benefits are based on your own work history (not a spousal benefit), the income limits are based on your own income.For example, if your income is $19,560 and your spouse’s income is $90,000, your benefits would not be subject to penalty.

Action Steps – Manage Your Income To Avoid Deductions To Your Own And Your Spouse’s Spousal Social Security Benefits

Work closely with your Registered Investment Adviser (RIA) to eliminate or mitigate benefit penalties while working.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA) is CEO of Skloff Financial Group, a Registered Investment Advisory firm specializing in financial planning, investment management and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.